Bank of England Q4 2021 Credit Conditions Survey

The Bank of England published its Q4 2021 Credit Conditions Survey this morning.

What they said

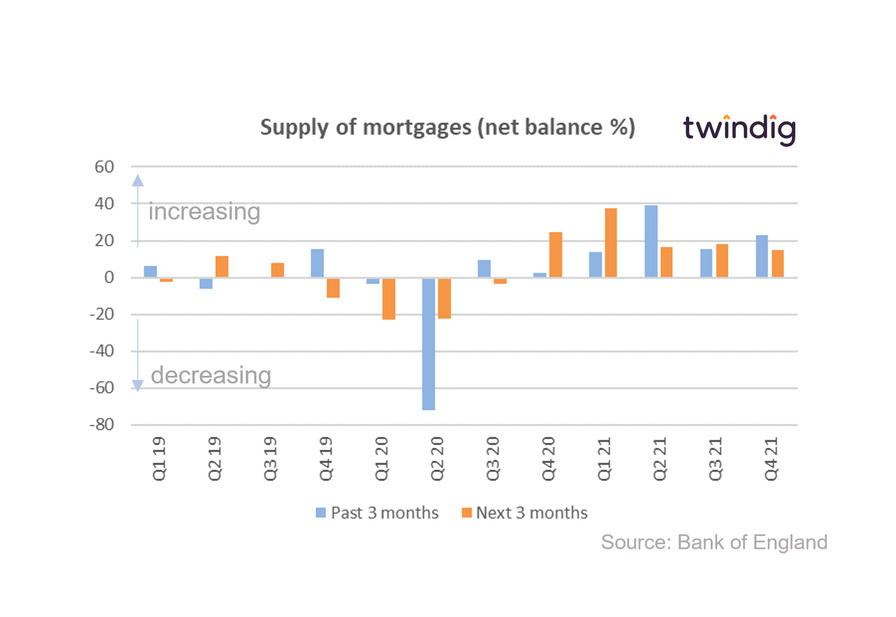

The availability of secured credit to households (mortgages) increased in the three months to end-November 2021 and lenders expect the availability of secured credit to increase over the next three months to end-February 2022

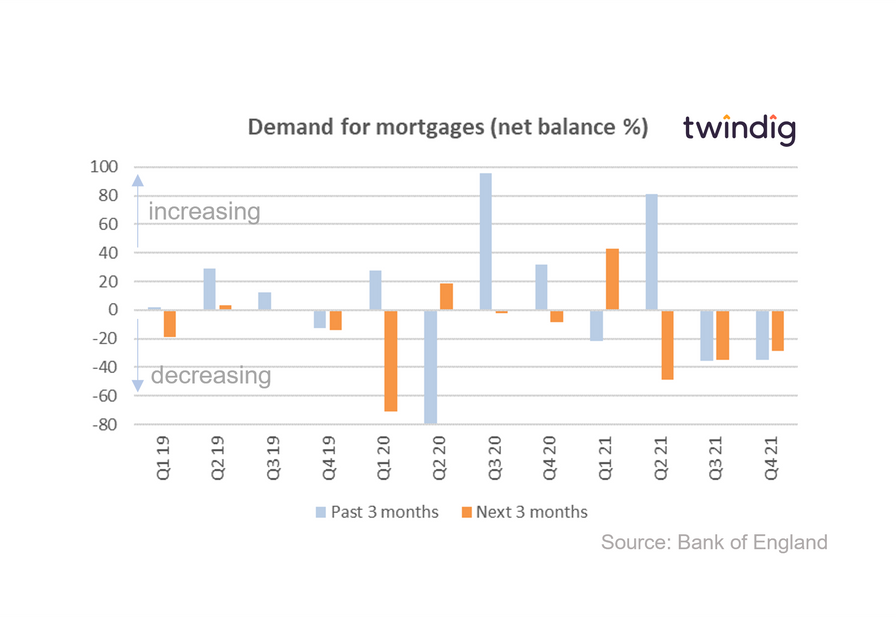

Demand for secured lending for house purchase decreased in the last quarter, and is expected to decrease in the first quarter of 2022.

Remortgaging activity increased in Q4, and is expected to decrease slightly in Q1

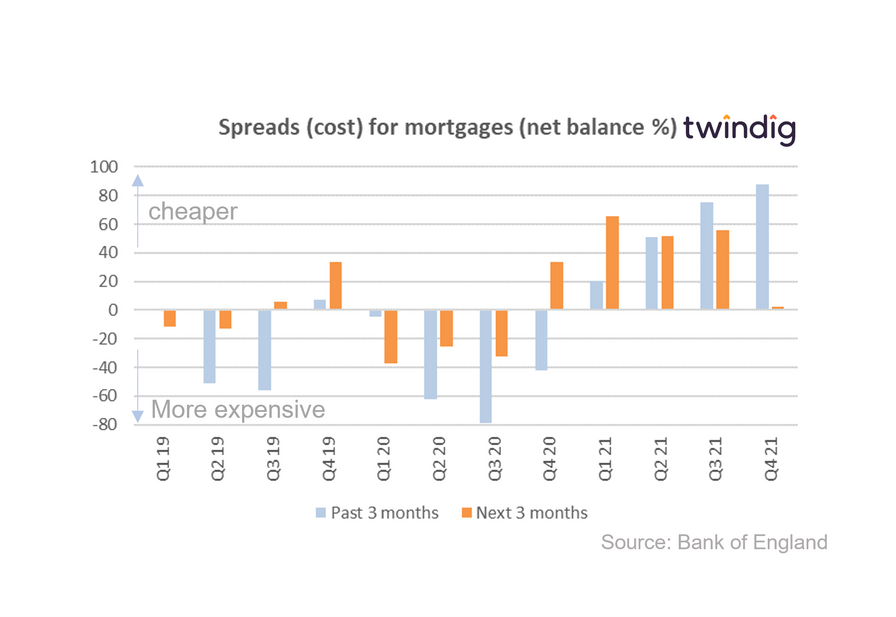

Lenders reported that overall spreads on secured lending to households (mortgage prices) relative to Bank Rate or the appropriate swap rate – narrowed (fell) in Q4, and were expected to be unchanged in Q1

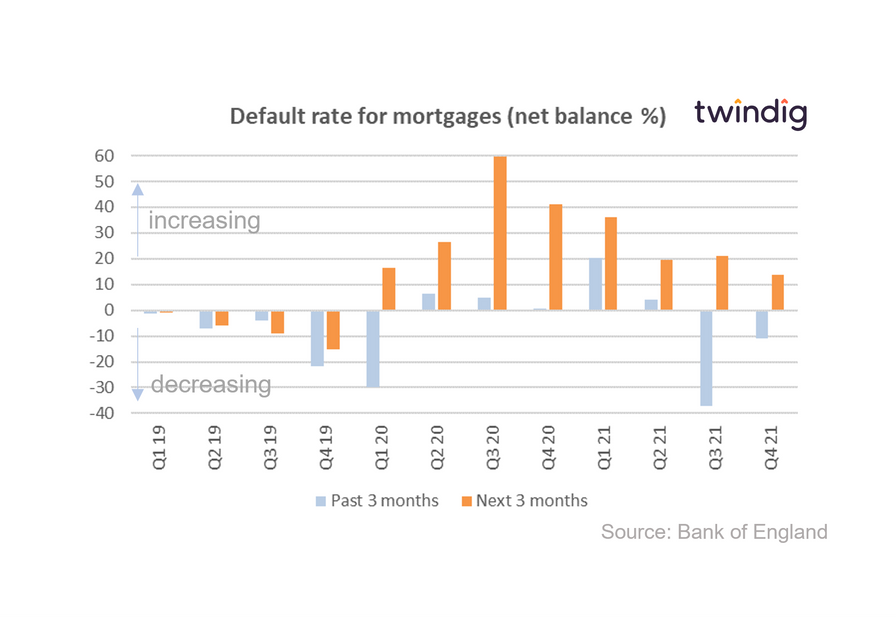

The net percentage balance for changes in default rates on mortgages decreased in Q4 and was expected to increase in Q1.

Twindig take

It is good news for homebuyers that mortgage lenders expect the supply of mortgages to increase in the coming three months. In our view, more supply means increased competition, which should help a lid on mortgage rates.

In fact mortgages costs (mortgage rates) did fall in the previous quarter and are expected to be unchanged in the coming three months, this is good news for borrowers, because although mortgage rates are expected to rise in line with changes in the underlying Bank Rate increased competition will keep them from getting too far ahead of it.

What we found most interesting in the latest Credit Conditions Survey was that lenders expect to see a fall in demand for both house purchase mortgages and in the level of remortgaging activity.

Mortgage approvals quickly bounced back following the end of the stamp duty holiday and so far this year housebuilders have reported high levels of homebuyer demand in their orderbooks ahead of the traditional spring selling season. With the UK economy starting to re-open, we would expect homebuyer demand to rise rather than fall. Time will tell.

Default rates are fell in the last quarter, but are expected to increase in the coming quarter. However, as illustrated in the chart below lenders have a habit of over estimating the level of mortgage defaults in the coming quarter. We are mindful of the anticipated rises in the costs of living, however we expect mortgage lenders to take a pragmatic approach with respect to individual mortgage holders repayment plans.