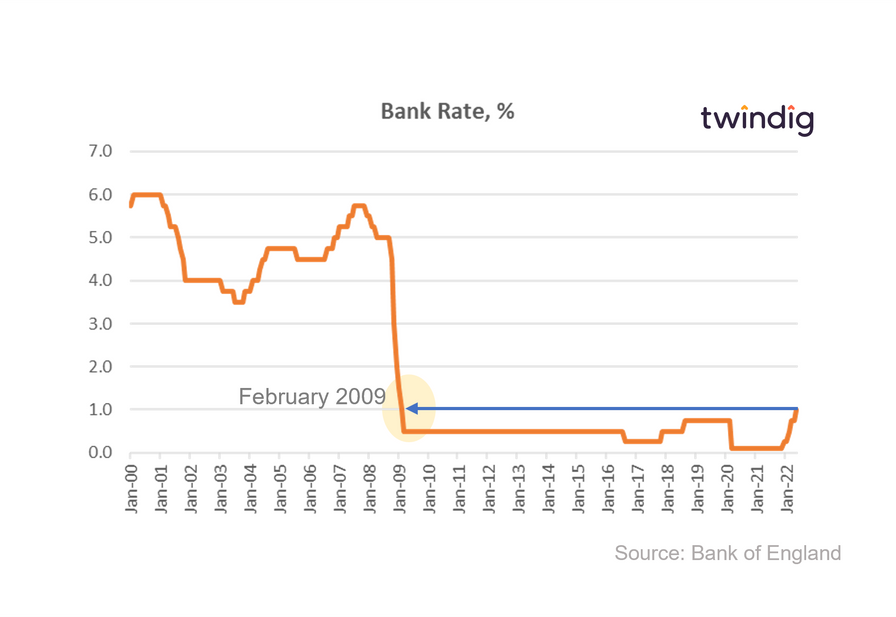

Bank rate reaches 13 year high

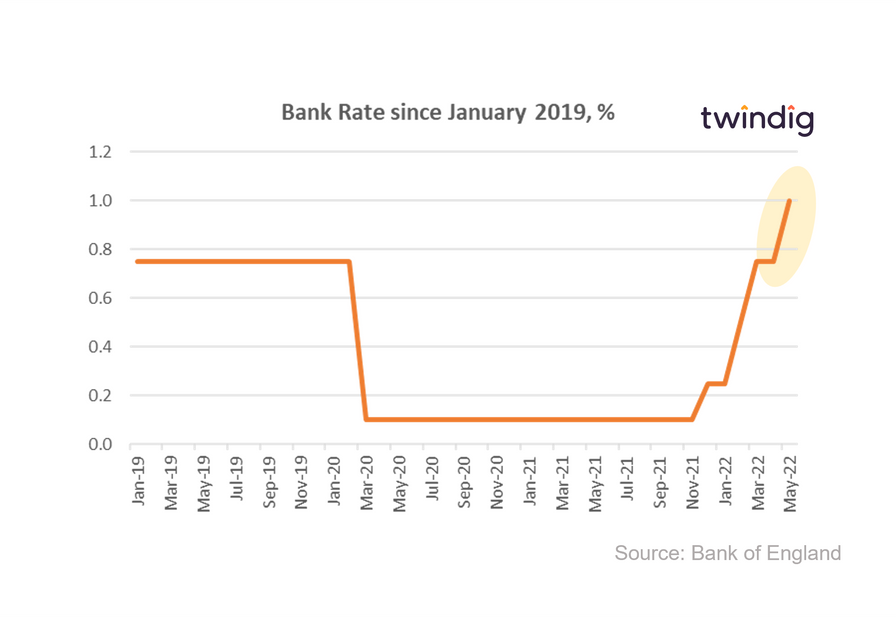

The Bank of England increased Bank Rate today

What the Bank of England said

MPC voted by a majority of 6-3 to increase Bank Rate by 0.25 percentage points, to 1.00%

Those in the minority preferred to increase Bank Rate by 0.5 percentage points, to 1.25%.

The Bank of England's central projections implied a path for Bank Rate that rises to around 2½% by mid-2023

Twindig take

The Bank of England sets monetary policy to meet a 2% inflation target. The 12-month Consumer Price Inflation (CPI) rate rose to 7.0% in March 2022, which was around one percentage point higher than the Bank of England had expected in February 2022.

The strength of inflation at 7.0% relative to the Bank of England's target of 2.0%, therefore, led to an increase in Bank Rate today.

The Bank of England's central projections implies that Bank Rate is currently on a path to reach 2.5% by mid-2023.

The Bank of England expects CPI to increase further to just over 9.0% in Q2 2022 before reaching a peak north of 10% at its peak in Q4 2022.

We would expect to see the increase in Bank Rate of 25bp passed through to new mortgage rates in due course.

What does today's Bank Rate Rise mean for my mortgage?

Around 80% of mortgaged households are currently on fixed-rate mortgages so today's increase will not impact them until their fixed-rate period ends. Around 1 in 5 are likely, therefore, to see their mortgage payments rise

The average mortgage rate for new mortgage business in March 2022 was 1.74%. If this rises to 1.99% then assuming a 25-year repayment mortgage the monthly payments will increase by £12 per month from £411 to £423.

To see how today's Bank Rate increase will impact your mortgage you can use our mortgage payment calculator

Relative vs Absolute

Whilst the 33% increase in Bank Rate is large in relative terms, in absolute terms it is quite small, yes Bank Rate has not been higher since February 2009, but the average Bank Rate between January 2000 and January 2009 was 4.70%