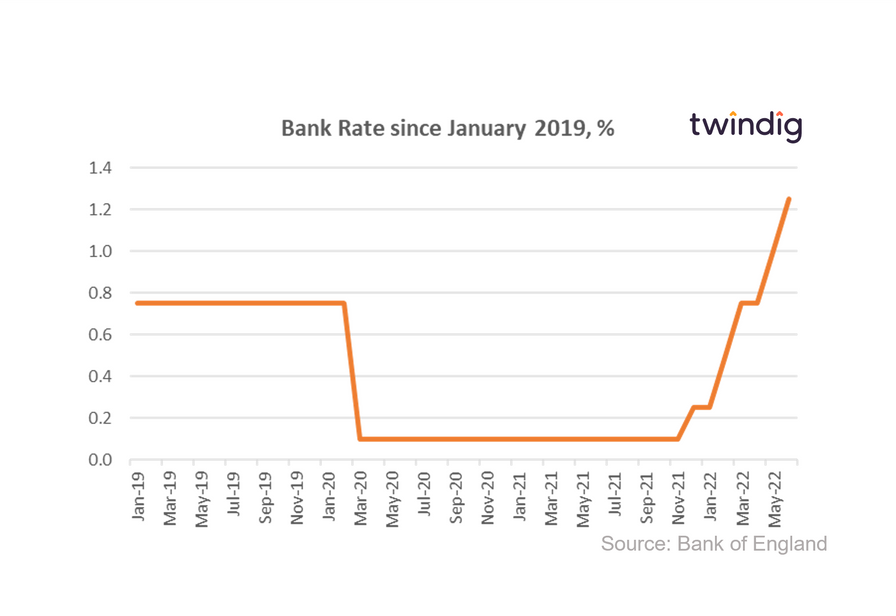

Bank rate rises to 1.25%

The Bank of England increased Bank Rate by 25 basis points to 1.25% today

What the Bank of England said

Bank Rate increased from 1.00% to 1.25%

The MPC voted by a majority of 6-3 for a 25 basis point increase

The MPC members in the minority voted for a 50 basis point increase

Twindig Take

The Bank of England's Monetary Policy Committee (MPC) sets monetary policy to meet the 2% inflation target, and in a way that helps to sustain growth and employment. It was no surprise therefore that with inflation running at 9% against a target of 2% The MPC voted to increase Bank Rate, the only uncertainty was by how much.

The MPC has a delicate balancing act when setting Bank Rate between controlling inflation and not adding further woes to the cost of living crisis.

The Bank of England expects that Consumer Price Index (CPI) inflation to be over 9% during the next few months and to rise to slightly above 11% in October.

How far will Bank Rate rise?

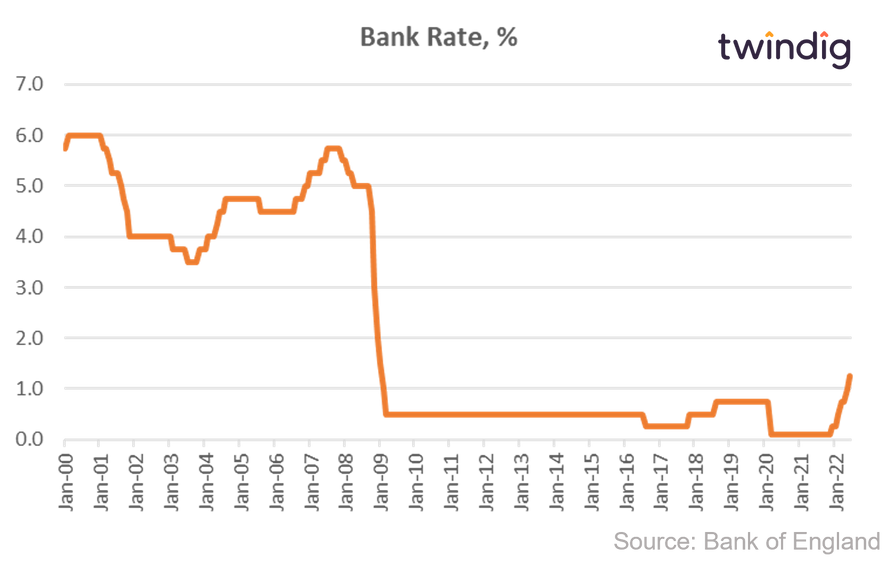

Bank Rate is now the highest it has been since January 2009 when it fell in response to the Global Financial Crisis

The latest MPC minutes suggest that the market-implied path for Bank Rate had risen materially since the MPC’s previous meeting, reaching around 2.9% by end-2022 and peaking at 3.3% in 2023. This path continued to be higher than the expectations for Bank Rate of respondents to the Bank’s latest Market Participants Survey, perhaps in part reflecting upside risks to the inflation outlook domestically and internationally.

How much will my mortgage cost now?

For those on fixed-rate mortgages the monthly payments will remain fixed for the duration of the fixed term, after that it is likely that the remortgaged rate will be higher than it currently is.

To calculate mortgage payments you can use the Twindig mortgage calculator below