Bank Rate: planning for a known unknown

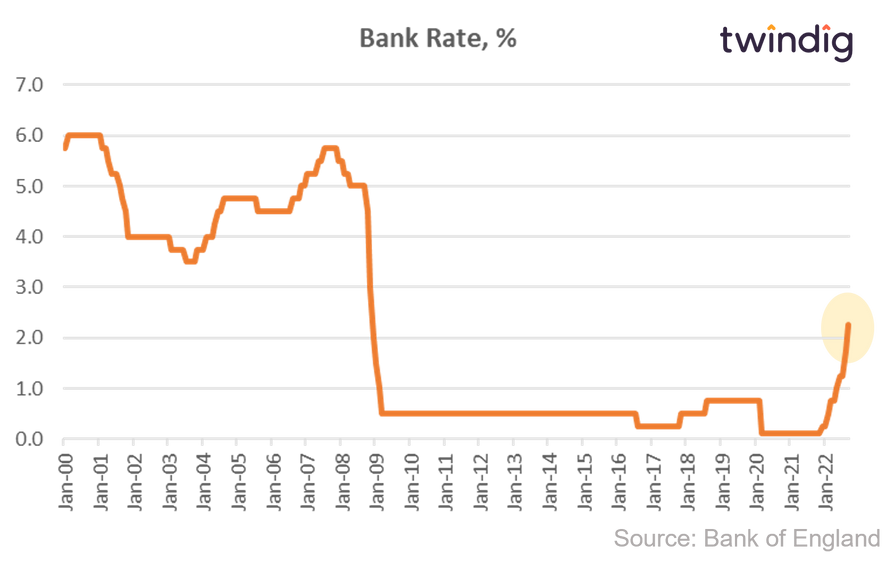

The Bank of England increased Bank Rate by 50 basis points to 2.25% today

What the Bank of England said

Bank Rate increased from 1.75% to 2.25%

The MPC voted by a majority of '5-4' for a 50 basis point increase

The rest of the MPC was split with three MPC members voting for a 75bp increase and one member for a 25bp increase.

Twindig take

Interesting to see such a split vote within the MPC, but as politicians know, in a first-past-the-post system, all that is needed is the slimmest of majorities.

With the mini-budget coming tomorrow it was a tough call for the MPC, planning for a 'known-unknown', knowing the mini-budget is coming, but not knowing what the mini-budget may contain.

The Bank of England's MPC sets Bank Rate with the aim of keeping inflation below 2%.

It is widely expected that the UK Government will take action tomorrow on energy bills, which will help contain inflation, but tax cuts (National Insurance and possibly income tax and stamp duty) will increase households' disposable income leading to further upward pressure on inflation and house prices.

Tax cuts, as we know, tend to benefit the richer rather than the poorer of society and so are likely to boost the spending power of the better off without necessarily helping those most in need who already pay little or no tax.

The next MPC meeting and Bank Rate decision is expected on 3 November when the unknown details of the known mini budget will have been revealed.

We believe that Bank Rate will rise again in November, possibly by another 50bp.

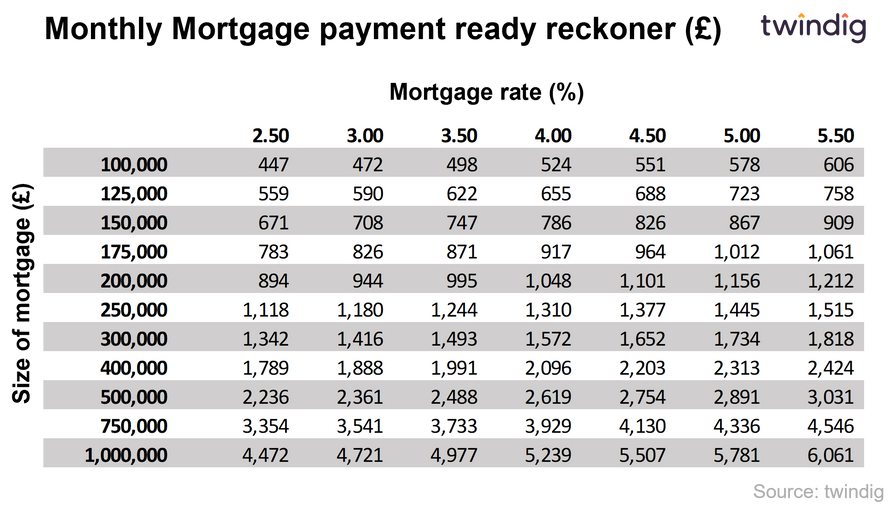

How much will my mortgage cost now?

For those on fixed-rate mortgages the monthly payments will remain fixed for the duration of the fixed term, after that, it is likely that the remortgaged rate will be higher than it currently is.

To calculate mortgage payments you can use the Twindig mortgage calculator below