Credit conditions going downhill

The Bank of England published its Q3 2022 Credit Conditions Survey on Thursday

What they said

Mortgage supply expected to decrease in the coming quarter

Demand for mortgages expected to decrease in the next three months

Mortgage rates are expected to rise during the next quarter

Twindig Take

It is important to note that the Q3 2022 Credit Conditions Survey was completed before the publication of the mini-budget on 23 September 2022. The UK Government blames the war in Ukraine for much of the upheaval in mortgage rates and the broader financial markets. The impact of the war in Ukraine was factored into the Q3 2022 Credit Condition survey, but the mini-budget was not. The mini-budget is therefore the major moving part, unfortunately, we will not see the full impact of the mini-budget on credit conditions until the Q4 Credit Conditions Survey in January 2023. However, in our view, it is the mini-budget rather than Putin that is currently waging war on interest rates, mortgage rates and the UK housing market

Lenders were asked to report changes in credit conditions in the three months ending 31 August 2022 (Q3), relative to the period between March and May, and expected changes in the three months to 30 November 2022 (Q4), relative to the period between June and August.

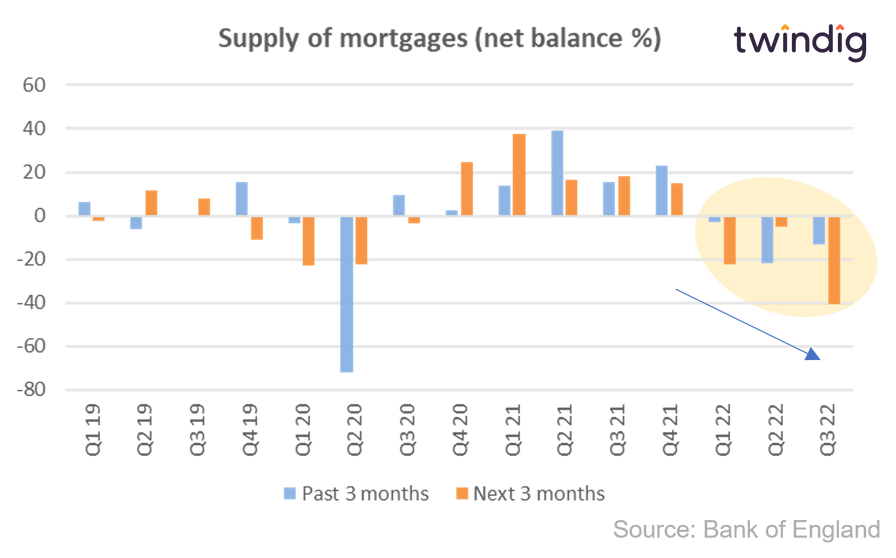

Supply of mortgages

Lenders reported that the availability of secured credit to households (mortgages) decreased during Q3 2022 and expect the availability of mortgages to decrease further in Q4 2022 as illustrated in the graph below. The decline in mortgage supply is not anticipated to be as large as in Q2 2020 when the COVID-19 pandemic struck, but the survey was conducted before Kwasi Kwartend announced his mini-budget on 23 September 2022.

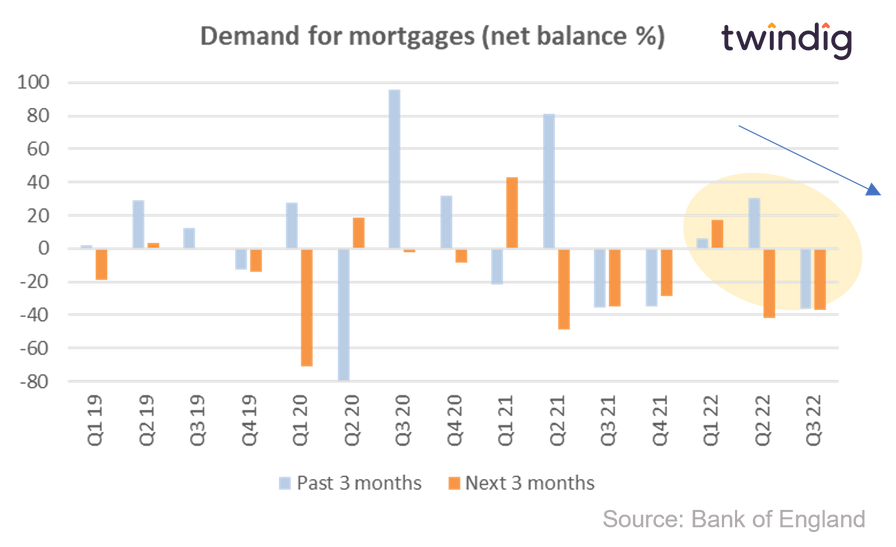

Demand for mortgages

Lenders reported that demand for secured lending for house purchases (mortgages) decreased during Q3 2022 and was expected to decrease in Q4 2022. The trend for demand is down, suggesting that housing market activity was already cooling before the mini-budget

However, lenders reported that demand for remortgaging increased in Q3 (as homeowners rushed to lock in low mortgage rate deals) and is expected to increase again in Q4 2022.

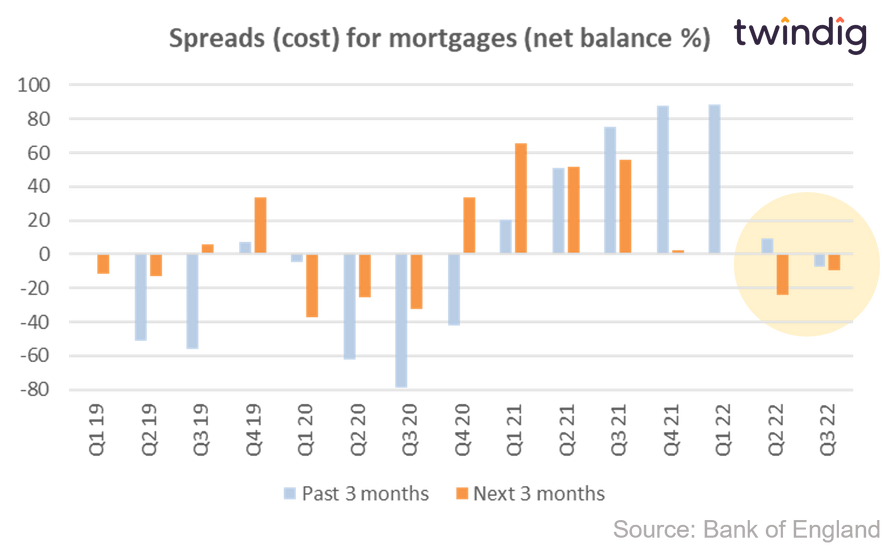

Mortgage rates

Lenders reported that overall spreads on secured lending to households (mortgages) relative to Bank Rate slightly widened in Q3 2022 and were expected to widen slightly in Q4 2022.

It is interesting to note that UK Prime Minister Liz Truss reports that interest rates are a matter for the independent Bank of England rather than the UK Government and that interest rates are rising because of the war in Ukraine rather than the mini-budget. Ahead of the mini-budget spreads were expected to widen slightly relative to Bank Rate, it will be interesting to see the outturn for Q4 once the impact of the mini-budget has been revealed.

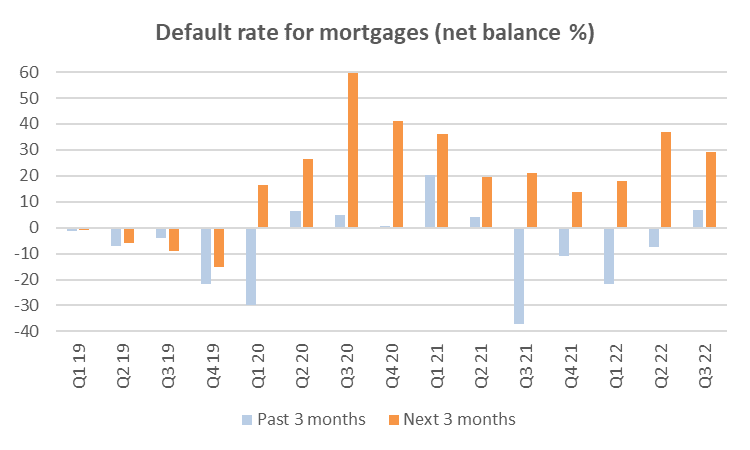

Mortgage defaults

The net percentage balance for changes in default rates on secured loans to households (mortgages) slightly increased in Q3 2022 and was expected to increase in Q4 2022