Credit conditions getting tighter as house prices fall

The Bank of England published its Q4 2022 Credit Conditions Survey on Thursday

What they said

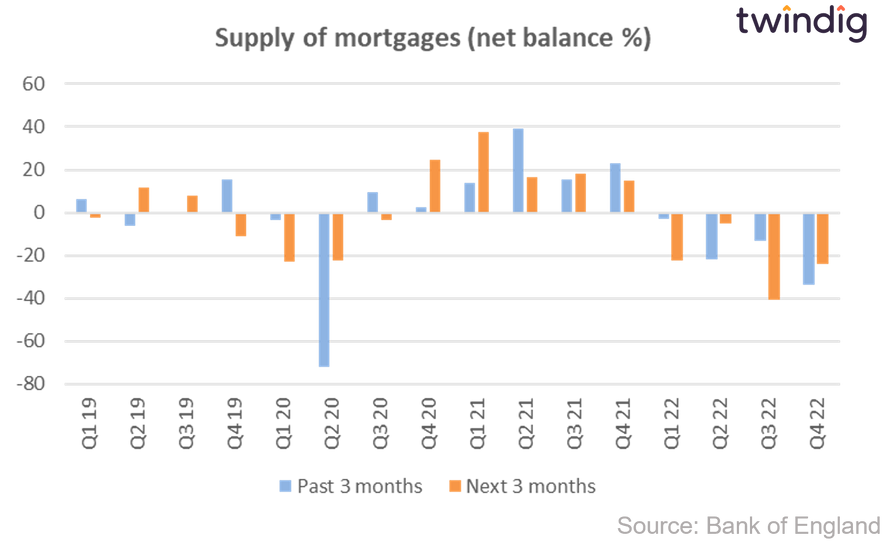

Mortgage supply expected to decrease in the coming quarter

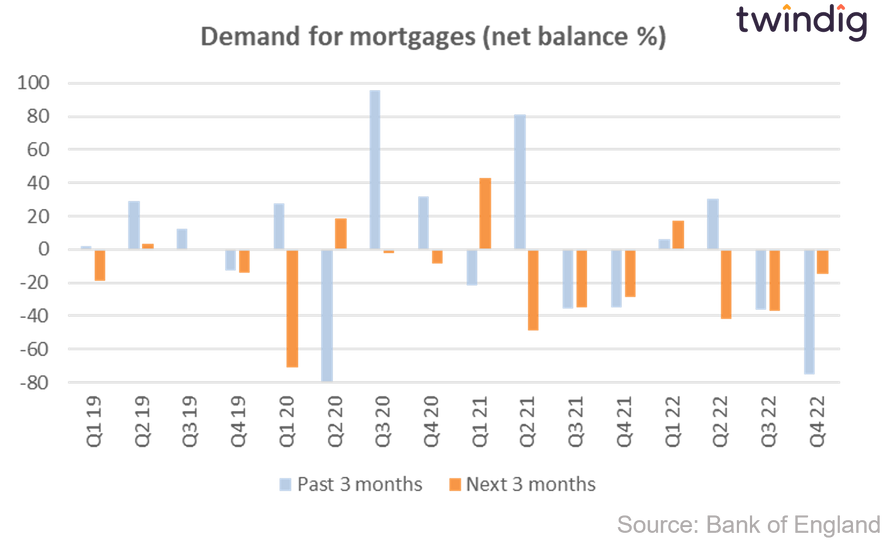

Demand for mortgages is expected to decrease in the next three months

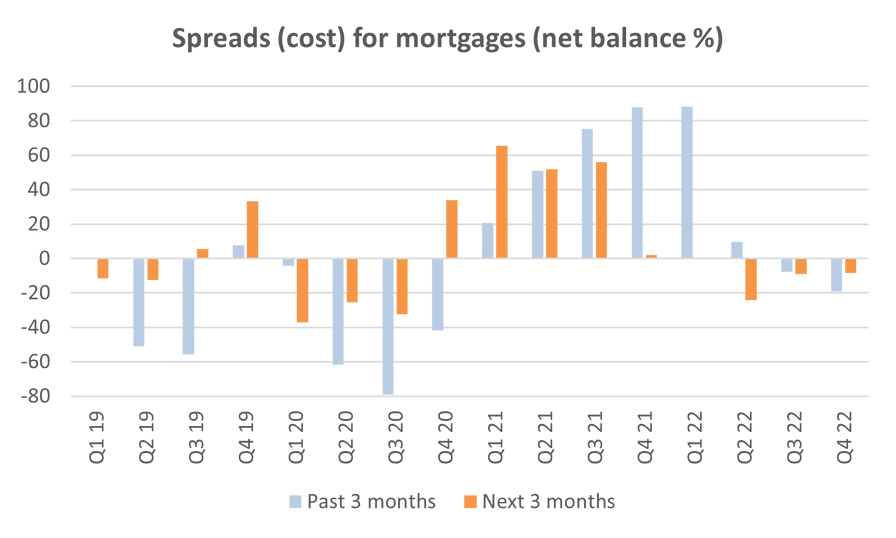

Mortgage rates rose in the last quarter and are expected to rise during the next quarter

Twindig Take

We had already seen in the mortgage approval numbers that mortgage market activity was contracting as November 2022 saw the lowest number of mortgage approvals since Lockdown 1, and mortgage supply is expected to reduce further in the coming quarter. The financial markets have stabilised since the disastrous mini-budget, but we are not out of the woods yet.

Interestingly, after a significant (mini-budget induced) fall in demand for mortgages in Q4 2022, demand is expected to continue falling in the coming months. However, we do not believe that the desire to buy a home has reduced, rather that as mortgage rates rise and lending criteria is tightened more would-be homebuyers are biding their time.

The Credit Conditions survey also suggests that mortgage spreads are likely to continue to widen - which means the gap between underlying interest rates and mortgage rates will get bigger. Therefore if underlying interest rates rise mortgage rates are likely to move upward as well.

It seems to us that after a couple of very hectic years in the UK housing market, 2023 is likely to be a quieter year where the housing market moves at a less frenetic pace.

Supply of mortgages

Lenders reported that the availability of mortgages decreased in the three months to the end of November 2022 and is expected to decrease further in the three months to the end of February 2023.

Demand for mortgages

Lenders reported that demand for mortgages reduced in Q4 2022 and was expected to decrease further in the three months ending February 2023

Mortgage rates

As already widely reported mortgage rates rose during Q4 as the gap between mortgage rates relative to The Bank of England's Bank Rate or appropriate swap rate widened in Q4 and the spreads are expected to widen slightly further in the three months ending February 2023.

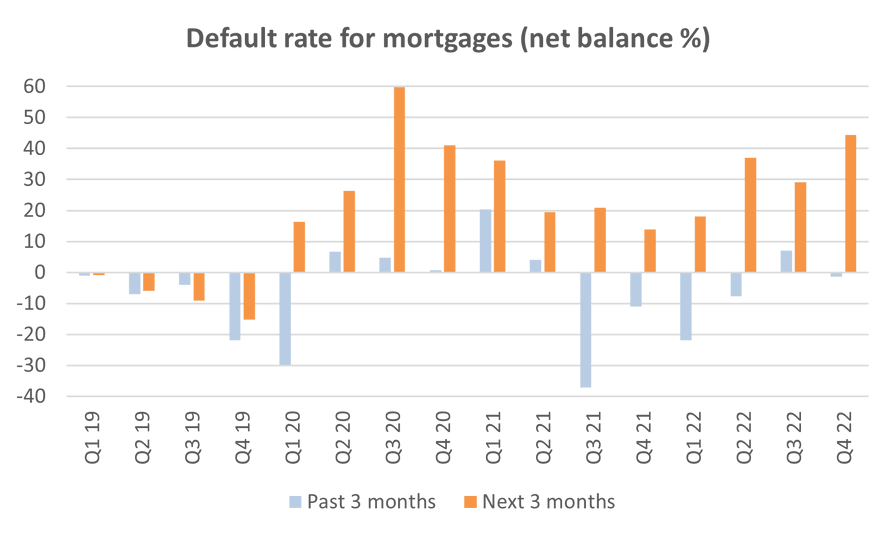

Mortgage defaults

The net percentage for changes in default rates on mortgages was unchanged in Q4, although it is expected to increase in the three months ending February 2023.