Halifax house prices buck the falling trend

The Halifax published its House Price Index for February 2023 this morning

What the Halifax said

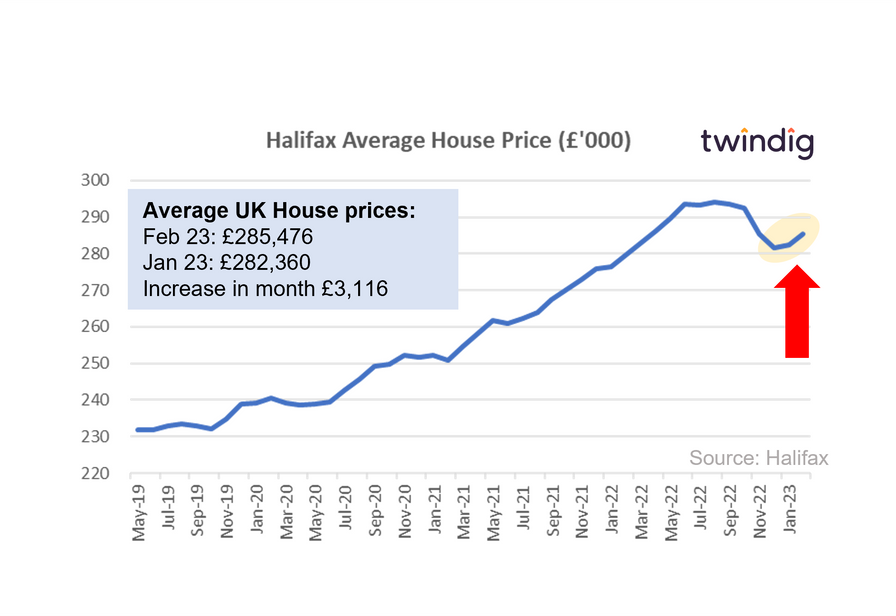

Average house price £285,476

House prices increased by 1.1% or £3,116 in February

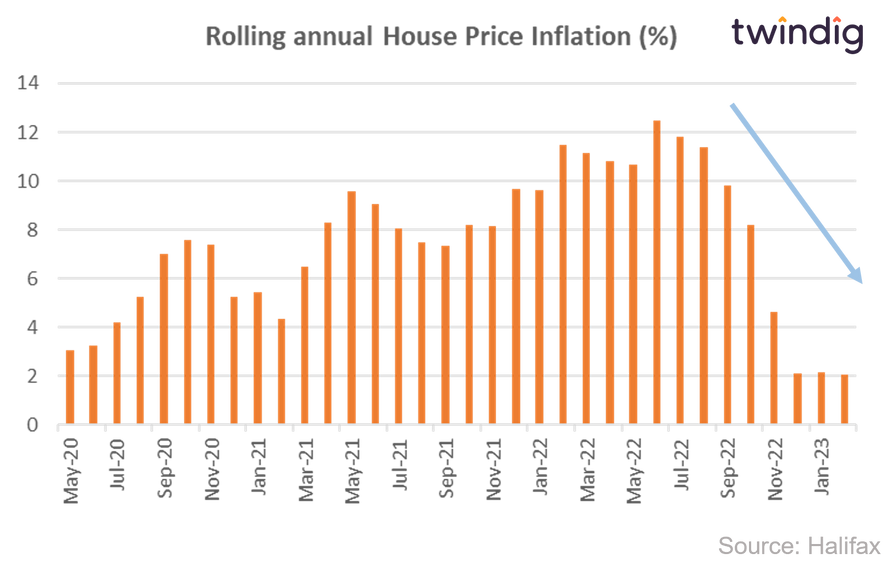

Annual house price inflation 2.1%

Twindig Take

The Halifax reported today that average house prices had increased during February and had been stable over the last three months, bucking the recent trend of falling house prices, it also revised its house price figure for January upwards. This is not the script the house price bears have been following and suggests the housing market is not as bleak as they may think. That said we are not raging bulls when it comes to house prices, but we believe that the underlying story of house prices is more complex and nuanced than attention grabbing headlines can convey.

According to the Halifax, recent reductions in mortgage rates and continuing resilience in the labour are helping to stabilise house prices.

House prices are currently around £8,500 or 2.9% below their August 2022 peak but £45,000 or 18.7% ahead of their pre-pandemic level.

However, annual house price growth is slowing across all regions and we are starting to see a divergence in house price performance by property type. The average price of flats has fallen by 0.3% over the last 12 months, whereas the price of terraced properties has risen by 0.3% and detached properties have increased by 1.5%.

Annual house price inflation for new build properties is at a four month high of 6.6%, whereas for existing homes the annual rate of inflation of 1.1% is its lowest in almost a decade.

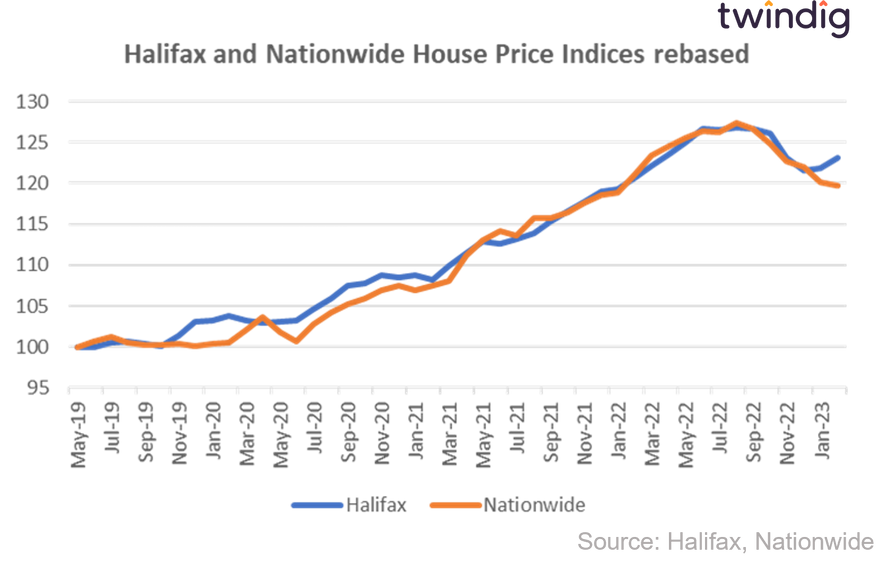

Halifax vs Nationwide House Price Index

It is rare for two of the UK's largest house price indices to move in different directions, but this week they did. Each index is based on mortgages that the lenders sell each month, so they are calculated using different sets of houses. However, both seek to standardise their data to rule out rogue results. The Twindig take on this divergence is that it demonstrates that the UK Housing market is neither in free fall enjoying boom times, and in our view it is more robust than the bears currently think.