Houselungo 1 August 21

A lungo length look at this week's housing market news

House prices up in the year, but down in July

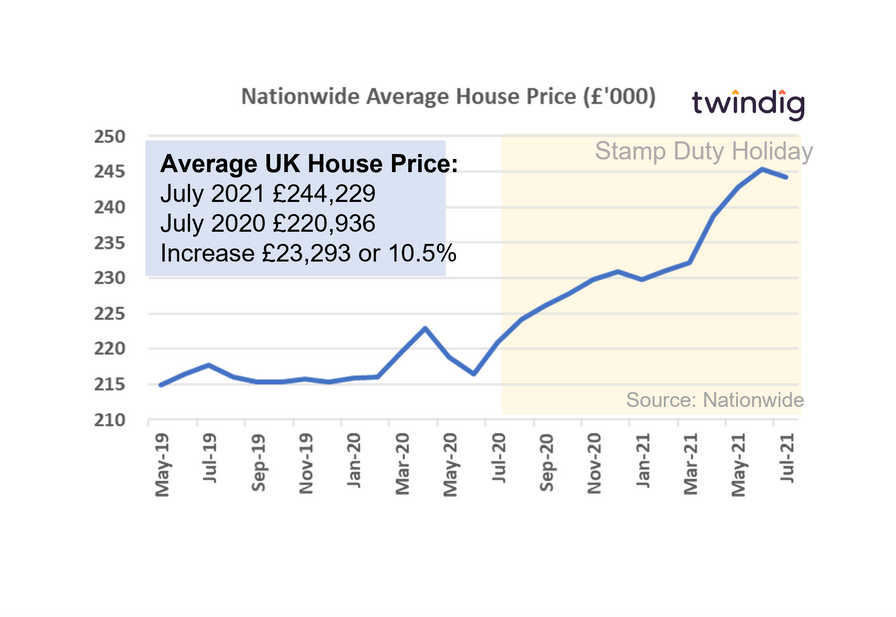

The Nationwide Building Society released its house price index for July this week

What they said

Average UK house price £244,229

0.5% or £1,203 lower than June 2021

10.5% of £23,293 higher than July 2020

Twindig Take

House prices increased by 10.5% or £23,293 during the last year, but fell by 0.5% or £1,203 in July as Stamp Duty Holiday relief is stepped down. Unluckily for those stepping on to or higher up the housing ladder, house prices had increased by £24,500 or 13 times the average stamp duty saving of £1,900 before the benefit was reduced. We do not expect house prices to return to their pre-stamp duty holiday levels anytime soon, but as the stamp duty holiday comes, the loss of stamp duty holiday benefit may well be reflected in underlying house prices.

Fixing the housing market ladder: Part 2 - Help more to sell

In our first article we looked at how to help those trying to a foothold on the broken lower rungs of the housing ladder. In this article, we look at how to fix the often ignored broken rungs at the top of the housing ladder.

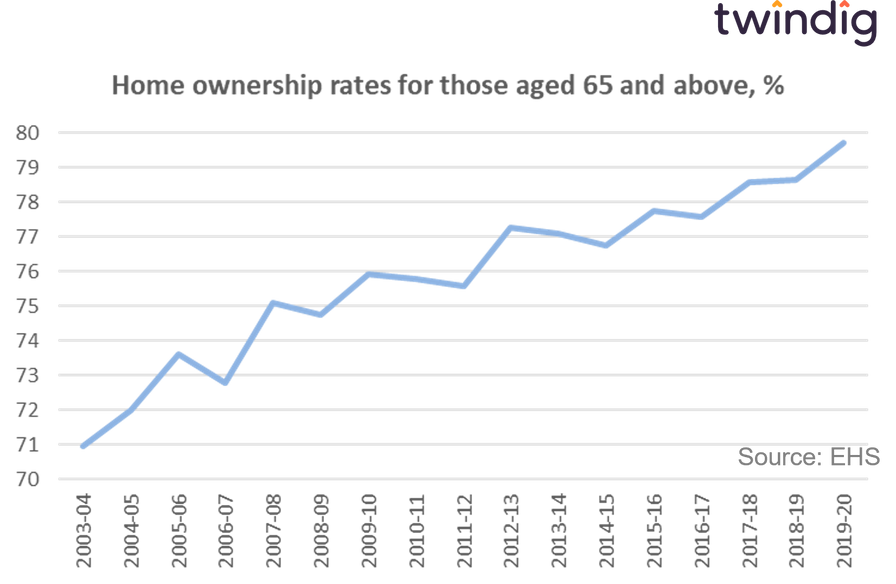

Equity rich, pension poor

Homeownership rates are only rising in the UK for one age group, those aged 65 and over, the so-called baby boomers.

However, whilst this generation may be housing rich, they are also often pension poor. Not all baby boomers and certainly not those coming up behind them are blessed with index-linked final salary pension schemes.

Our analysis of FCA pension data suggests that the average pension pot of those at retirement age is currently around £62,000.

For a comfortable retirement, many retired households will need to top up their pensions and taking some of their profits from their property could help them enjoy life whilst helping others get a foothold on the housing ladder

How the pandemic changed our homes

The Future of Home is a collaborative report, published by the Nationwide Building Society, which looked at the impact of the pandemic on the housing market and how it has changed our homes. The report also used the pause caused by the pandemic as an opportunity to bring together a range of experts and organisations to take a fresh look at the key issues facing the UK housing market today: Availability, Affordability and Sustainability.

You can read the Nationwide's full report here or our summary below:

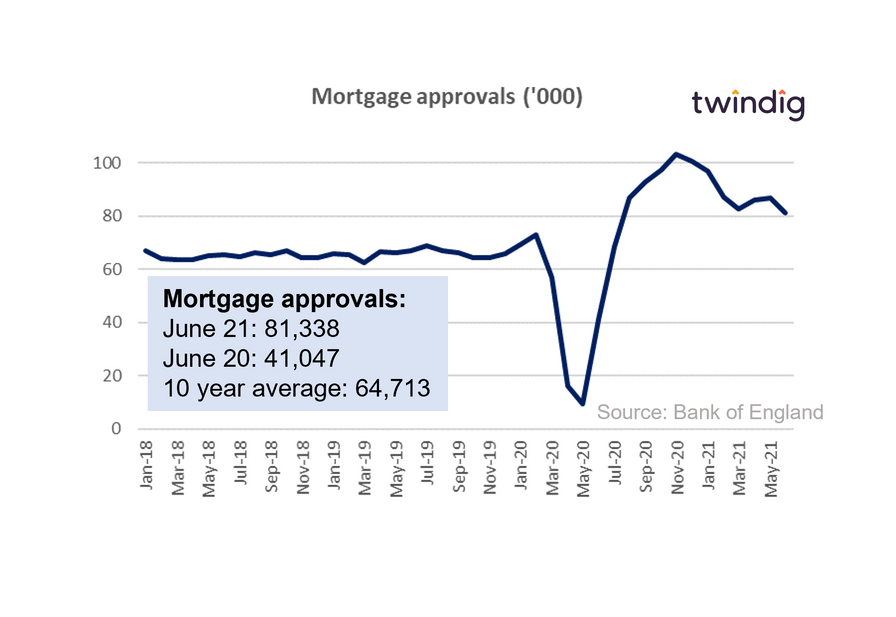

Mortgage approvals almost double in June

The Bank of England released its mortgage approval data this morning for June 2021

What they said

Mortgage approvals in June 2021 81,338

This is 98% higher than in June 2020 (41,047)

This is 26% higher than the 10 year average of 64,713

Twindig take

Mortgage approvals in June 21 were 81,338 almost double their level a year ago (41,047), but were 6.5% lower than May 21 as we headed towards the first of two Stamp Duty Holiday cliffs. As of 1 July 2021 the Stamp Duty Holiday only applies to homes costing up to £250,000 rather than £500,000.

However, the new stamp duty holiday threshold of £250,000 is still higher than the average UK house price. Yesterday the Nationwide reported that average UK house prices were £244,229, so plenty of house purchases will still benefit from the stamp duty holiday.

Mortgage approvals in June were 26% above their 10-year average and we expect them to remain above average until the stamp duty holiday comes to an end on 30 September this year.

Aside from the stamp duty we also note that the latest Bank of England Credit Conditions survey reported that lenders expect to increase mortgage supply and reduce mortgage rates over the coming months which will also underpin approvals, in our view.

The main constraint for mortgage approvals is likely to be a shortage of homes for sale, with limited amounts of stock on the market we may see a further tempering of mortgage approvals.

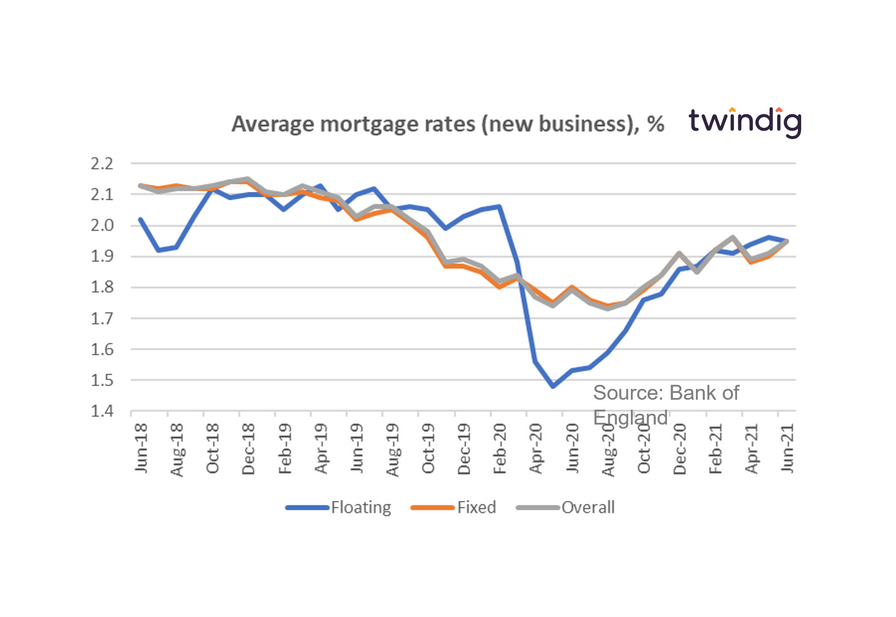

Mortgage rates move up and down in June...

The Bank of England also released data on mortgage rates for June this week

What they said

Average new business rates for floating rate mortgages fell from 1.96% to 1.95%

Average new business rates for floating rate mortgages rose from 1.90% to 1.95%

The overall average mortgage rate for new business now 1.95%

Twindig take

The latest data from the Bank of England today reported that the overall average mortgage rate for new business fell from 1.96% to 1.95%, not a big fall, but in a historical context rates are very low and every little helps...

Meanwhile, fixed mortgage rates increased from 1.90% to 1.95%. Once again in a historical context rates are very low.

Borrowers should also be aware that in the latest Bank of England Credit Conditions Survey lenders reported that they expect to increase the supply of mortgages and lower mortgage rates in the coming months. This is good news for those seeking a mortgage in the next few months and also suggests that lenders believe that the risks of a significant fall in house prices are lower than they were.