Houselungo 4 Apr 21

A lungo length look at this week's housing market news

Houses earning £12,000 per year

The Nationwide Building Society published its house price index for March 2021 this week

What they said

Average UK House price in March 2021 was £232,124

House price growth since the start of lockdown 1: £12,551

Current Government policy likely to boost housing market over the next six months

Twindig Take

The latest Nationwide House Price Index suggests UK house prices have increased on average by more than £1,000 per month over the last year to £232,134. UK house prices refuse to be locked down. As the UK stays at home it also appears to be moving home. The stimulus of the Stamp Duty Holiday and furlough schemes have certainly helped and being forced to stay at home has encouraged many to move home as the staycation became the movecation. The Nationwide suggests the longer-term outlook remains uncertain and that as the Stamp Duty Holiday romance fades house prices may falter. However, for the last year, the robustness of house prices has surprised us all on the upside and the music is unlikely to stop for the next six months.

New and Improved Stamp Duty Calculator

This week we updated our Stamp Duty Calculator to reflect the latest time limits of the different stamp duty

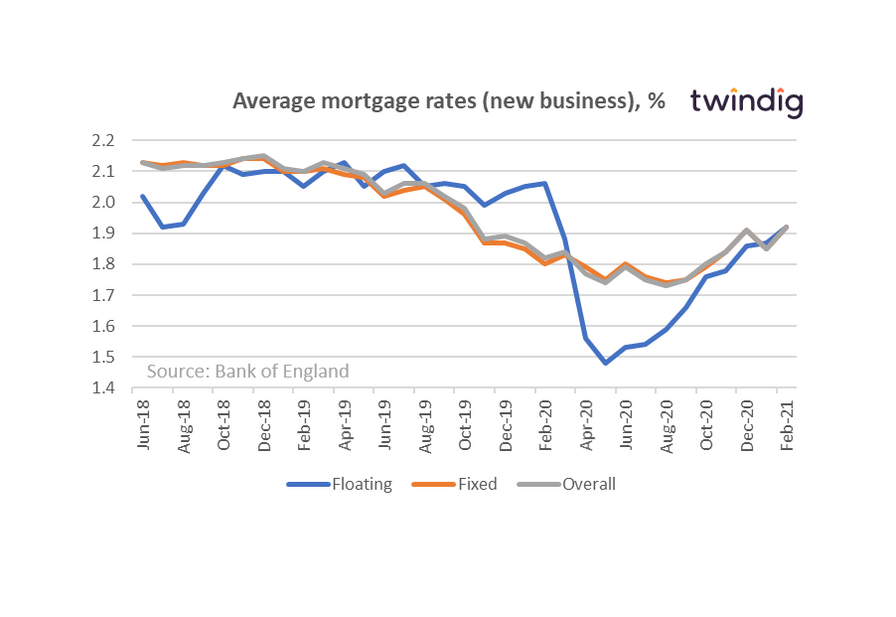

Mortgage rates moving on up

The Bank of England released average mortgage rate data for new mortgages in February 2021 this week

What they said

Average mortgage rate for fixed rate mortgages 1.92%

Average mortgage rate for floating rate mortgages 1.92%

Twindig take

The latest data from the Bank of England reports that average mortgage rates for new business increased in February 2021 to 1.92% for both fixed and floating rate mortgages, it is unusual to have fixed and floating mortgage rate parity. The increasing trend in mortgage rates is likely to encourage more homebuyers to take advantage of the Stamp Duty holiday. Property portals and estate agents are likely to be very busy this Easter weekend.

Bank of England Mortgage Approvals

The Bank of England released its mortgage approval data for February 2021 this week

What they said

Mortgage approvals for February 2021 were 87,669

This is 20% higher than February 2020

10% below January 2021

Twindig take

Bank of England Mortgage Approvals for Feb 21 87,669, which is 20% higher than February 2020 but 10% lower than January 21. We expect approvals to increase in March 2021 following the Stamp Duty Holiday extension announcement in Rishi Sunak’s Budget 2021. Despite the fall in the number of Mortgage approvals in February 2021 they were still 38% higher than the 10 year average of 63,500.

Jeremy - you are a £100 winner!

Jeremy from Surbiton was the winner of last weeks £100 Prize Draw, but this week, it could be you - new users or existing Twindiggers referring a friend are eligible to enter this weeks prize draw sign up here

Are you next week's winner?

Refer a friend to Twindig or register yourself to claim your FREE Home Valuation Report and a chance to WIN £100 - Entry closes 4pm UK time Wednesday 7th April 2021