Houselungo 11 Apr 21

A lungo length look at this week's housing market news

House Prices Reach Record Highs

What they said

Average UK house price £254,606

Increase in month +1.1% (+£2,750)

Increase over the last year +6.5% (+£15,430)

Twindig take

First Time Buyer Deposits also reach record highs

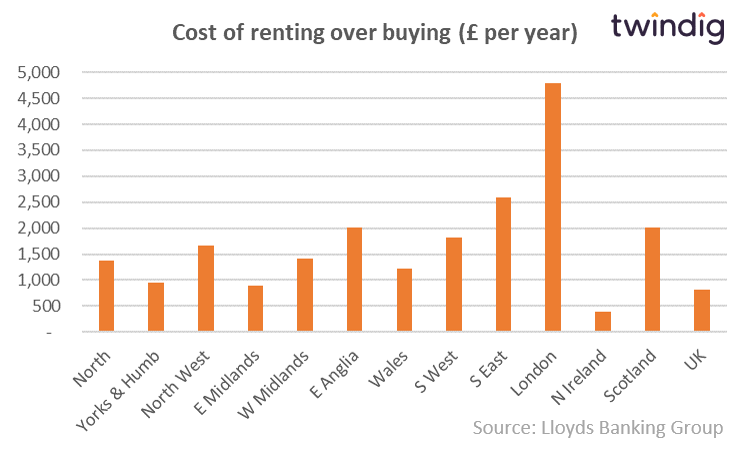

A report from Lloyds Bank this week reported that raising a deposit is still the biggest challenge for those looking to get on to the property ladder, but the average first home deposit has gone up by another £11,000 since the start of the pandemic to £59,000, putting homeownership out of reach for many. The report also says that for those lucky enough to have a deposit the costs of owning a property are lower than the cost of renting by around £70 per month or £824 per year.

London renters £5,000 worse off than London buyers

Whilst across the UK average buying costs are £824 per year lower than the average rental payments, in London this leaps to £4,788 an additional cost of almost £400 per month.

In the new world of working from home, this will cause many to question whether the cost of living within the bright lights of London is worth the extra cost.

To avoid the next Stamp Duty Cliff... Be Prepared

We all have love/ hate relationships with deadlines, most of us start off with good intentions but then end up panicking following a period of delay and procrastination.

The Conveyancing Association offered good advice on Radio4 this week: Be Prepared. Getting all your documents ready ahead of time can save you both time and ultimately save you money.

Twindig has details of all the documents you need if you are thinking of selling, so if you haven't already registered visit twindig.com claim your property and start preparing for your next move.

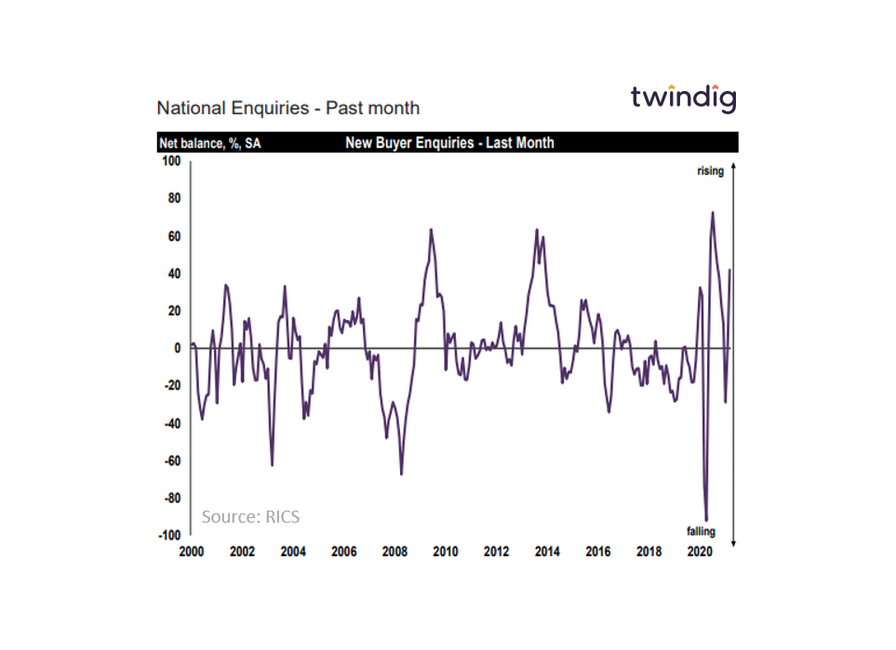

Stamp Duty Holiday fuelling housing demand

The Royal Institution of Chartered Surveyors released an update on the UK housing market this week

What they said

Buyer enquiries and agreed sales gain significant impetus following stamp duty holiday extension

House prices continue to move higher across the UK

Forward looking indicators point to renewed momentum being sustained over the near term

Twindig take

It is telling that the latest RICS UK residential housing market survey highlights the extension of the Stamp Duty holiday as a significant driving force behind this renewed momentum of the housing market. Housing market activity and prices had started to decline as the stamp duty deadline approached, but the Stamp Duty Holiday extension was a shot in the arm for the UK Housing market. Short term stimulus packages do not provide the answer to the long term nature of the housing crisis we find ourselves in, they exacerbate the highs and lows rather than providing a path to market equilibrium. With lockdown easing have we missed an opportunity to take a long and hard look at how to fix our broken housing market whilst we had pressed the pause button on the wider UK economy.

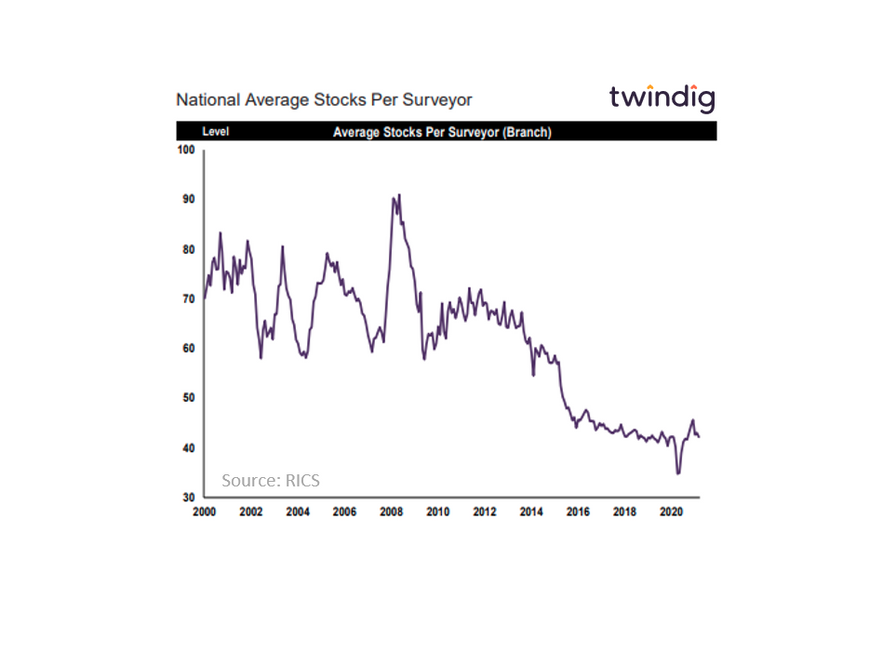

Shortage of homes for sale

Although the UK housing market is buoyant, you might not be able to find what you are looking for. Around 4 in 10 people across the country know where they want to live next but there are far fewer homes on the market. So what do you do if the home you want to buy isn't on the market? Twindig can help because you can find and follow any home on twindig the 1 million currently on the market and the 27 million that aren't. If you follow a property we will update you on that property each month.

Simply visit twindig.com find the property or properties you are interested in by entering in either the street name or postcode, view the property and then follow it and we will take care of the rest

Winkworth

Leading mid-upper market London franchisor of estate agents released their 2020 financial results this week

What they said

Revenues flat at £6.4m

Profit before taxation £1,5m down 6%

Forecasting a strong year in 2021 due to unlocking of the economy and Government stamp duty stimulus

Twindig take

The stability of Winkworth's revenues and profits in the face of the pandemic is in our view quite remarkable. Showing the strength and depth of the skills of both the management team and their franchisees to deal with a crisis.

Catering for the mid-upper market Winkworth serves those more able to move and to make lifestyle choices such as moving out of the city or the search for more space within it.

Winkworth reports that it has a strong pipeline and backlog of transactions to complete and the relaxing of lockdown rules and the continued roll-out of the COVID vaccinations is likely to see demand for Winkworth's services rise rather than fall in the coming months.

Zara - you are a £100 Winner!

Zara from Stockport was the winner of last weeks £100 Prize Draw, but this week, it could be you - new users or existing Twindiggers referring a friend are eligible to enter this weeks prize draw

Are you next week's winner?

Refer a friend to Twindig or register yourself to claim your FREE Home Valuation Report and a chance to WIN £100 - Entry closes 4pm UK time Wednesday 14th April 2021