Houselungo 16 October 22

Is Hunt Right for housing?

The departure of Kwasi Kwarteng, the u-turn on corporation tax and the appointment of Jeremy Hunt did little to settle the nerves of residential investors. Some asked if these attempts to rearrange the chairs in the cabinet were akin to rearranging deckchairs on the Titanic.

Few would argue against the view that the trajectory of the Kwasi budget put the Government on course for a head-on collision with the Bank of England, the former pushing for growth and the latter trying to restrain it. The net result is Bank Rate, and therefore mortgage rates, need to be increased faster and higher than previously thought. This would hurt homeowners.

However, what spooked the markets most was the lack of detail behind the mini-budget headlines. How were the tax cuts to be funded? The corporation tax cut u-turn is welcome, and it helps a bit, but what we need, is more detail.

The challenges for Hunt

The first challenge for Mr Hunt is to explain in detail how he will balance the books until he has done that the markets will remain unsettled, and the more markets are unsettled, the higher mortgage rates will rise.

The second challenge he faces is to put the housing market back on an even keel. Whilst much of the recent economic turbulence can be traced back to the contents of the mini-budget, unfortunately for Hunt the housing market started to drift south as living costs and mortgage rates started to head north.

Might the Government pay my mortgage?

As the cost of living crisis rages and mortgage rates rise, could we see the Government step in to help households pay their mortgages? At first glance, this probably seems absurd. However, before the COVID pandemic, and perhaps even just before the start of the war in Ukraine, few would have thought that the UK Government would be helping households pay their fuel bills.

A National Housing Fund (NHF) would reduce mortgage payments, not by paying the mortgage and offering temporary respite, but by buying part of the home, providing a permanent reduction in the mortgage itself.

The NHF would help keep existing homeowners in their homes, provide equity loans to help aspiring homeowners buy a home, and increase the public ownership of homes providing security of tenure to those who need it most.

Recession recession recession rather than growth growth growth

RICS released their September 2022 UK Residential Market Survey on Thursday

What RICS said

New buyer enquiries fall for the fifth month in a row

Indicators on new instructions and agreed sales remain negative

The limited supply of homes for sale continues to support house price growth

Twindig take

As the UK Government continues to be criticised for the unfunded tax cuts in the mini-budget, the housing market is starting to run out of steam.

The Government's pursuit of growth is at odds with the Bank of England's calls for restraint and interest rates are likely to rise significantly in the coming weeks and months.

This growth/restraint conflict is starting to take its toll on the housing market. Housebuilder Barratt reported yesterday that it is battening down the hatches, and RICS reports today that homebuyer demand is falling. The message of growth, growth and more growth is falling on deaf ears. the mini-budget appears to be ushering a recession rather than growth, is Liz Truss the Keyser Soze of the anti-growth coalition?

Credit conditions cooling

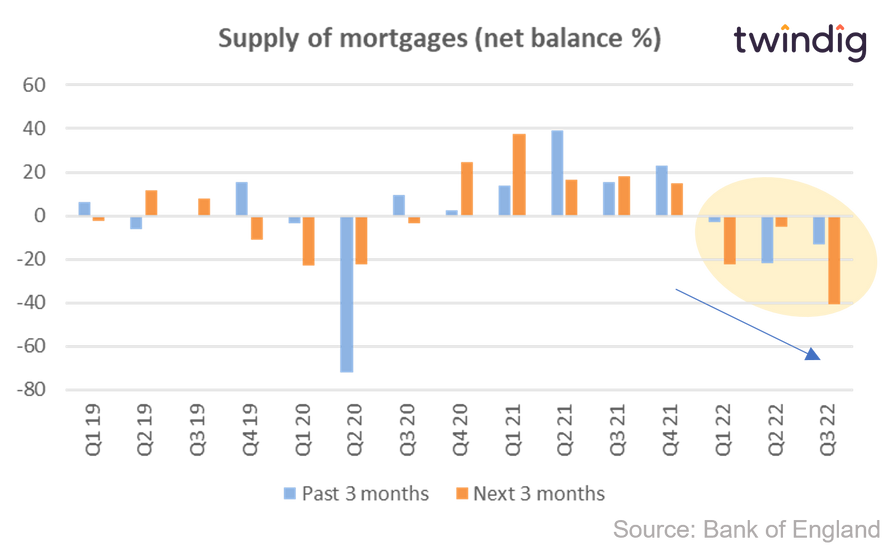

The Bank of England published its Q3 2022 Credit Conditions Survey on Thursday

What the Bank of England said

Mortgage supply expected to decrease in the coming quarter

Demand for mortgages expected to decrease in the next three months

Mortgage rates are expected to rise during the next quarter

Twindig Take

It is important to note that the Q3 2022 Credit Conditions Survey was completed before the publication of the mini-budget on 23 September 2022. The UK Government blames the war in Ukraine for much of the upheaval in mortgage rates and the broader financial markets. The impact of the war in Ukraine was factored into the Q3 2022 Credit Condition survey, but the mini-budget was not. The mini-budget is therefore the major moving part, unfortunately, we will not see the full impact of the mini-budget on credit conditions until the Q4 Credit Conditions Survey in January 2023. However, in our view, it is the mini-budget rather than Putin that is currently waging war on interest rates, mortgage rates and the UK housing market

Barratt Battens down the hatches

Whilst Liz Truss talked of growth, growth and growth, in its trading update today Barratt spoke of uncertainty, uncertainty and uncertainty. Whilst it is not a member of the apocryphal anti-growth coalition it seems the mini-budget has stymied Barratt's growth aspirations

What Barratt said

Net average private reservations per week 188 (FY22 281)

Average private reservation rate 0.55 (FY22 0.85, FY21 0.87)

Help to Buy 12% of reservations (FY22 21%, FY21 51%)

Forward sales 13,314 homes (October 21: 15,393; October 20: 15,135)

Land purchases in the period 813 plots (FY 22: 3,735)

Twindig take

In our view, Barratt is doing the right things in times of market stress, battening down the hatches. The last thing a housebuilder wants in a slowing market is a lot of stock (or WIP). As demand falls build rates will slow.

With uncertainty ahead, Barratt has also significantly reduced its land buying, this both preserves cash and protects the Group against the risk of falling land prices.

The outcome of these actions is, however, the opposite of Government's goal of 'growth, growth and growth'. Although we are sure that Barratt would like to pursue the growth agenda, the impact of mini-budget has been to cut homebuyer demand which has led Barratt to cut its growth plans accordingly.

Twindig Housing Market Index

At 60.2 the Twindig Housing Market Index is at its lowest level since 22 May 2020, having fallen by 2.6% this week. It is fair to say that residential investors do not like the mini-budget and are sceptical about Liz Truss's second go at putting things right, perhaps in the days to come it will be third time lucky....

The departure of Kwasi Kwarteng, the u-turn on corporation tax and the appointment of Jeremy Hunt as Chancellor of the Exchequer did little to settle the nerves of residential investors. Some asked if these latest moves were akin to rearranging deckchairs on the Titanic

Whilst the UK stock gained a little ground on Friday, the sterling US dollar exchange rate weakened and residential investors were taking a cautious view. Initially, it does not look as if Liz Truss has hit a home run and uncertainty will linger not until Mr Hunt presents his medium-term plan in a few weeks.