Houselungo 21 Mar 21

A lungo length look at this week's housing market news

UK Housing market worth £7.56 trillion – how big is your slice?

The latest research from Savills estimates that the UK's housing stock is now worth £7.56 trillion, more than four times the value of the FTSE 100 (the value of the biggest 100 companies on the London Stock Exchange). The value of UK housing rose by £380bn during 2020, whilst most of the UK economy is down and out during the pandemic, the housing market is going from strength to strength.

We believe that the most interesting statistic in Savills research is that the value of mortgaged owner-occupied homes is only £2.5 trillion. This means more than a staggering £5.0 trillion worth of UK property is owned mortgage-free, twice as much as the value of those homes being purchased with a mortgage.

This suggests that we have a very unequal distribution of housing wealth across the country – those with property and those buying property. Property typically gets passed down from one generation to the next and therefore the level of inequality is likely to grow, in our view. The £5.0 trillion will get re-invested in the property market as it is passed from generation to generation, those without a significant deposit will increasingly struggle to get a foot on the property ladder.

Over time, we expect the value of the bank of mum and dad will continue to rise, but it will be made of fewer and fewer mums and dads.

It will be interesting to see if this line of thought has influenced the UK Government’s thinking about Capital Gains Tax reform or will the myopia of short-term electoral cycles lead to politicians sidestepping the difficult decisions.

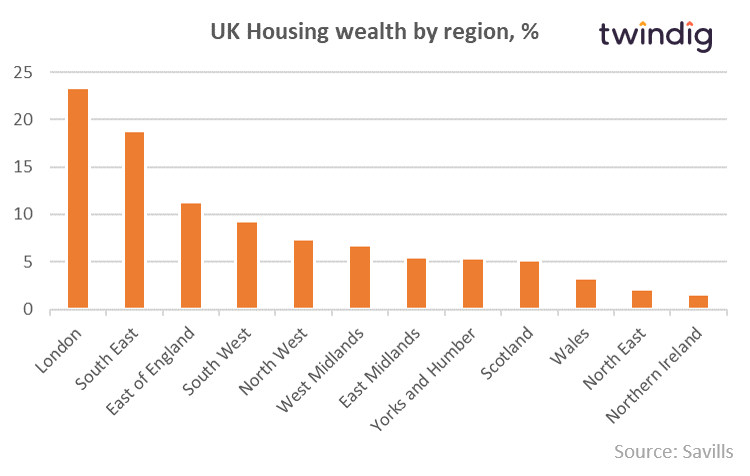

The UK's housing wealth is concentrated in London and the South East, which account for just over 40% of the housing wealth in the UK, as detailed below:

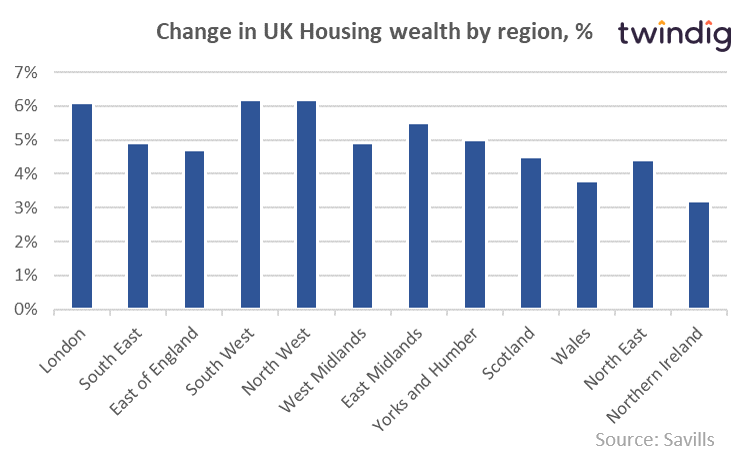

However, it was the North West and South West which had the biggest percentage increase in value, tied at 6.2% each.

For an indication of how much your house is worth visit twindig.com

Capital Gains Tax Reform

Capital gains tax and income tax rates to be normalised?

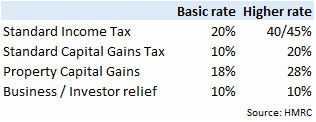

Tuesday 23rd March 2021 is ‘Tax-day’ where he UK Government might signal a change in Capital Gains Tax rates, perhaps bringing them in-line with income tax rates, which would mean some hefty increases on the gains of buy to let properties.

We show the current Capital Gains Tax and Income Tax rates in the table below

For a higher rate (45%) income tax payer selling a buy to let property and making a capital gain of £100,000 the current capital gains tax liability is potentially £28,000, but this could rise to £45,000 if income and capital gains taxes are normalised, an increase of 61%.

For more details about Capital Gains Tax you can read our UK Capital Gains Tax Guide

95% LTV mortgages are back

Yorkshire Building Society (YBS) is the first lender to launch a 95% LTV Mortgage product since the start of the COVID-19 pandemic. The launch comes shortly after Chancellor Rishi Sunak announced he would launch a Government-backed 95% LTV mortgage guarantee scheme. The YBS product is not part of the Government scheme, but first-time buyers will be hoping it is the start of a competitive mortgage market for those with smaller deposits. The five-year fix is offered at 3.99% with a £995 fee.

YBS was quickly followed by Bank of Ireland offering a 5-year fix at 4.05% with no fee. Expect more high LTV products to come in the coming days and weeks.

However, a 95% LTV mortgage is not a silver bullet for would-be first-time buyers. They certainly help those with a small deposit, but due to lending multiple restrictions once over the initial deposit hurdle one might find they do not have sufficient income to secure the mortgage required for the home of their dreams.

This is not the fault of the mortgage or mortgage provider. Lending restrictions are in place for sensible reasons and to reduce the risks of another 2007 style credit crunch. However, the mortgage capacity constraint issue once again highlights the fact that house prices have become divorced from wages. If you don’t have access to the bank of mum and dad (ie if mum and dad don’t own their property) it is likely that you will struggle to get on the housing ladder.

Changes to capital gains tax could help, by reducing the firepower of the bank of mum and dad, but will any UK Government be brave enough to hike taxes whilst so many voters are homeowners?

Property logbooks a step closer

The Government supported Home Buying and Selling Group launched its BASPI (Buying and Selling Property Information) form this week. The aim is for sellers to get sale ready by completing the form early in the sale process, to speed up the sale, so that buyers, agents, conveyancers and mortgage brokers have all the information they need to complete the purchase and sale. If it sounds like the ‘HIPS’ (Home Information Packs) from a few years ago that is because they are similar, but the current stamp duty holiday induced bottlenecks have increased the desire by all involved to once again try to speed up the home buying and selling process.

Land Registry going digital (again..)

Following on from the acceptance of e-signatures, this week the Land Registry introduced its first Digital Identity Standard meaning that conveyancers can use digital services to verify their client’s identities securely and safely on-line. With the shift to remote working and staying at home this is a big and welcome step for such a paper-based institution. This will also help speed up the home buying and selling process which could come in very handy as we approach the next stamp duty holiday deadline.