Houselungo 29 May 22

Do you live in one of the UK's hottest housing markets?

We often talk about 'the UK housing market' and 'UK house price inflation' as if there is one housing market and one rate of house price inflation. Neither is true.

The UK is made up of hundreds if not thousands of tiny housing markets, which operate independently of each other. One person buying a home in Swindon does not move the housing market in Stockwell.

In this article, we look at the hottest 25 housing markets across the country.

Biggest house price increases last month

The biggest house price winners last month were in Kensington and Chelsea in London where house prices increased by 5.6%

In second place came North Lincolnshire in Lincolnshire where house prices increased by 5.3% and in third place with house prices rising by 5.1% was Richmondshire in North Yorkshire.

Are you a typical landlord?

Twindig has delved into the data from the latest English Private Landlord Survey to see what the typical landlord looks like, how many properties they own and how much their rental properties are worth. So are you a property Paul or a Loretta landlord?

How many properties does the typical landlord own?

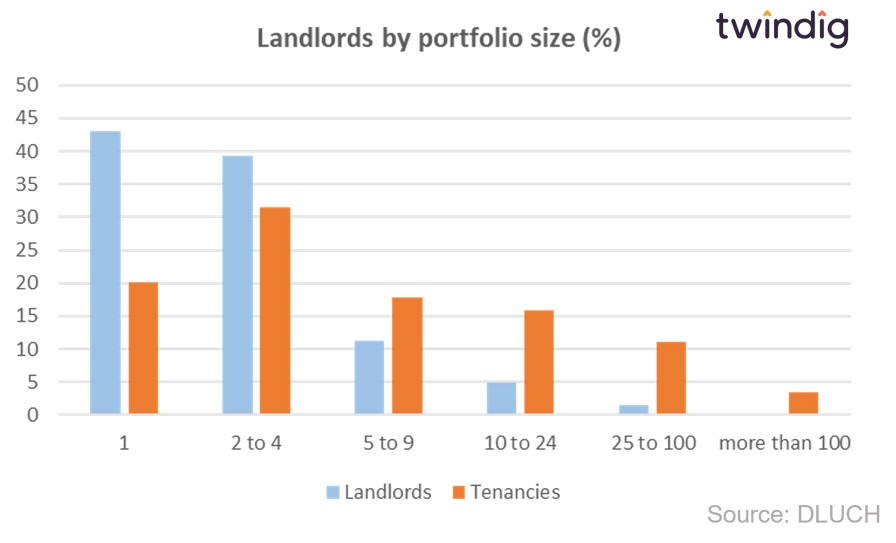

Just under half of all landlords (43%) own one property, these landlords make up 20% of tenancies. A further 39% own between two and four properties making up 31% of tenancies, and the remaining 18% of landlords own five or more properties, representing almost half (48%) of tenancies.

How old is the typical landlord?

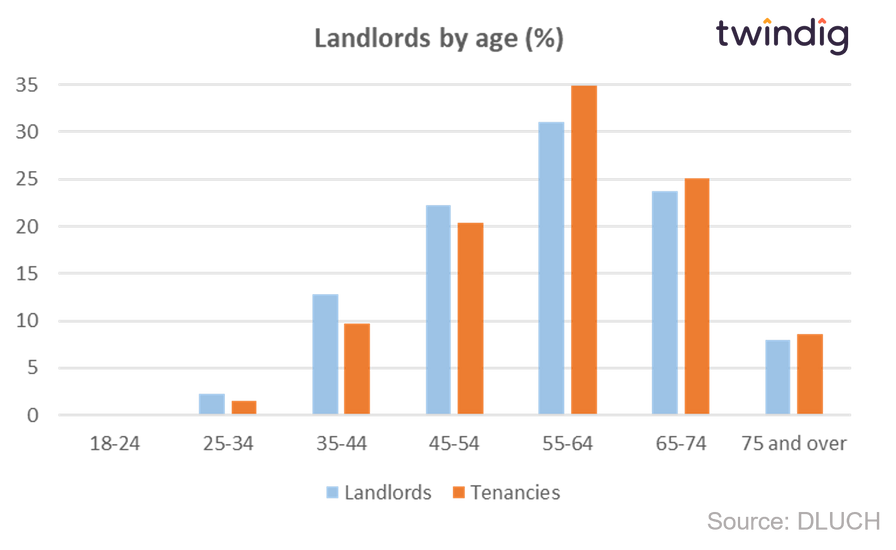

The median age of an individual landlord was 58, almost two thirds (63%) of landlords were aged 55 or older, representing 68% of tenancies.

Landlords are typically older than the general population. At the time of the 2011 Census, the median age for the population of England and Wales was 39 years

The truth about rent rises

How often do landlords increase the rent on their rental properties?

Is Onladder the best way to get on the housing ladder?

What is OnLadder?

OnLadder is one of the latest startups trying to solve the first-time buyer affordability problem. The idea is that OnLadder helps you get on the housing ladder.

What problem is Onladder trying to solve?

OnLadder is seeking to solve the deposit problem. When buying a home mortgage lenders are keen for the homebuyer to have some skin in the game. The lender does not want the mortgage to cover 100% of the purchase price. The gap between how much the mortgage company will end and the price of the home is the deposit gap. The homebuyer needs to provide a deposit to fill that gap. The problem is that the deposit gap is often very large indeed and we are increasingly seeing that if a first-time buyer does not have help from the Bank of Mum and Dad, they are unlikely to be able to secure a deposit large enough to fill the deposit gap.

How does OnLadder fill the deposit gap?

OnLadder aims to provide first time buyers with a deposit loan. OnLadder will loan you the deposit you need to help you get on the property ladder. The deposit loan is a form of second charge mortgage.

Will OnLadder provide all of my deposit?

No. You will need to have saved up or provide a 5% deposit. If the home you are looking to buy costs £200,000 you will need a deposit of £10,000.

Housing transactions fall in April, but not a lot

HMRC released provisional housing transaction data for April 2022 this week

What they said

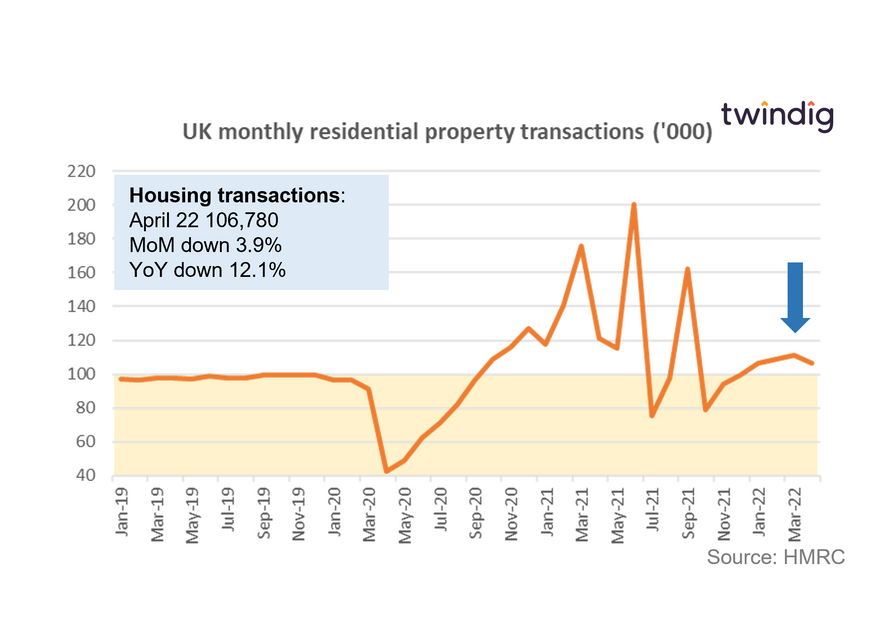

Housing transactions in April were 106,780

This is 3.9% or 4,370 lower than in March 2022

This is 12.1% or 14,630 lower than in April 2021

Twindig take

Housing transactions fell for the first time in six months in April 2022, the first fall since October 2021, which followed the end of the Stamp Duty Holiday in September 2021.

However, at 106,780 housing transactions remain 9% (around 9,000) ahead of their long-run monthly average. The temperature of the housing market may have cooled a degree or two, but it is certainly not running out of steam.

Impact of the cost of living crisis?

In our view, it is too early to tell if the cost of living crisis is impacting the level of housing transactions. The housing transactions which completed in April 2022 will have been 'sale agreed' or sold subject to contract much earlier in the year and possibly towards the tail end of 2021. A three to four-month lag between sale agreed and completion would actually be pretty good in the current climate

We expect that the cost of living crisis will temper housing market activity, but we won't know by how much for several months to come and we won't be able to calculate its full impact until the crisis itself has subsided.

Will house prices fall as housing transactions dip?

Twindig Housing Market Index

In the week that saw housing transactions fall for the first time in six months, the Twindig Housing Market Index increased by 1.9% to 76.2 this week.

It was an interesting week for estate agents this week. The cut-price, low touch challenger estate agent Purplebricks revealed that despite the heat in the housing market its sales and revenues were falling, whereas the more traditional estate agency group Belvoir reported that trading during the four months to 30 April 2022 its revenues were up 14% on the same period in 2021, with the property division up 8% and the financial services division up 20%. LSL, one of the largest estate agency groups in the UK reported that revenues for the first four months of 2022 were in-line with those achieved in the buoyant market of 2021. It seems that the Purplebricks model has not caught on, and its performance is at odds with that of the mainstream market. The traditional model certainly appears to be the model preferred by homebuyers and sellers.