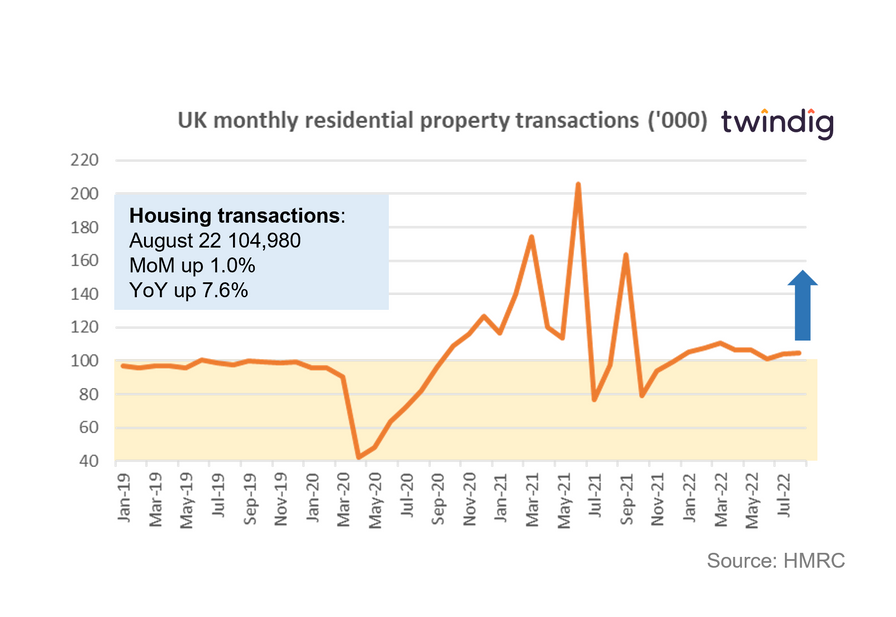

Housing transactions rise in August

HMRC released provisional housing transaction data for August 2022 this week

What they said

Housing transactions in August 2022 were 104,980

This is 1.0% higher than in July 2022

This is 7.6% higher than in August 2021

Twindig take

It is fascinating that despite a growing number of housing market commentators turning bearish, the housing market continues to surge forward. Seasonally adjusted housing transactions in August were 104,980, some 7% ahead of the long-run average of 98,100.

We are several months into the cost of living crisis and whilst we appreciate that housing transactions completed in August were berthed earlier in the year, the fact that so many people are choosing to see their purchase through to completion in the face of the rising cost of living and mortgage rates is testament to the strength of the underlying housing market. Budgets might be being stretched, but it appears that when it comes to our homes, our biggest assets, we are not yet ready to call time on moving home.

The rumours in the press today that Prime Minister Liz Truss and Chancellor Kwasi Kwarteng will announce radical plans to cut stamp duty in the mini-budget on Friday will further strengthen the foundations of the housing market, in our view, leading to an increase in housing transactions in the coming months