Housing transactions rise unexpectedly in July

HMRC released provisional housing transaction data for July 2022 this week

What they said

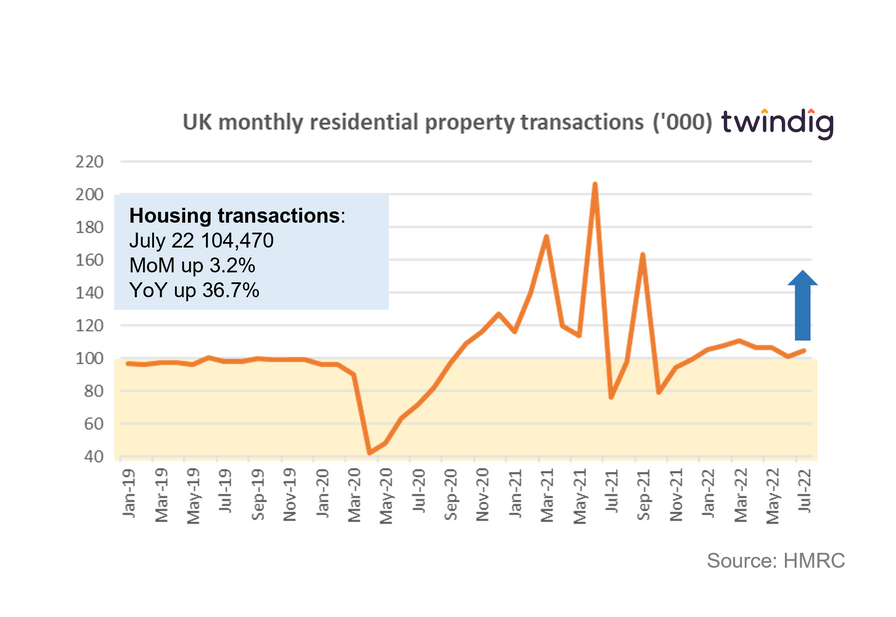

Housing transactions in July 2022 were 104,470

This is 3.2% higher than in June 2022

This is 36.7% higher than in July 2021

Twindig take

We were pleasantly surprised to see (seasonally adjusted) housing transactions rise in July 2022 following three months of decline and at 104,470 housing transactions were comfortably ahead of their long-run average of 98,000. Those that are calling time on the upbeat housing market appear to be out of step with what is actually going on at the coal face. Mortgage approvals, due out next week will provide a better view as to the future direction of housing transactions, but the fact transactions rose and were above the long-run average shows that cost of living increases and mortgage rate rises have yet to cause the housing market any significant pain.

The leap in housing transactions on the 'year on year' (YoY) basis sounds more impressive than it really is and is flattered by the dip in housing transactions last July following the end of the £500,000 stamp duty holiday in June 2021, which led to a flood of additional housing transactions.