Housing transactions rise in October

HMRC released provisional housing transaction data for October 2022 today

What they said

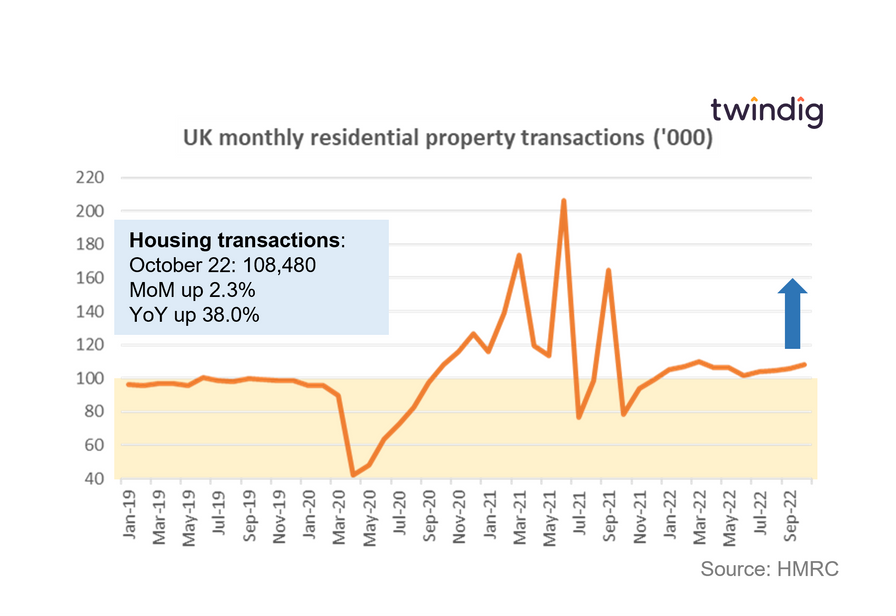

Housing transactions in October 2022 were 108,480

This is 2.3% higher than in September 2022

This is 38.0% higher than in October 2021

Twindig take

Housing transactions increased in October. At first glance, this increase following the disastrous mini-budget is surprising. However, it is more a reflection of how long housing transactions take to complete than a reflection of the housing market conditions in October. Many agents and conveyancers are reporting that transactions are taking longer to complete and we know of many people who are finding these completion bottlenecks very frustrating.

Housing transaction volumes are, however, encouraging, in the face of increasing mortgage rates and large increases in the costs of living significant numbers of households are both willing and able to move home.

At 108,480 housing transactions in October were 11% higher than their long-term average, which suggests to us that reports of crashing housing markets in the UK are somewhat inaccurate. We are not suggesting that the market is as buoyant as it was, but it does still appear to be in good health

Mortgage calculator

If you are concerned about mortgage rates you can use our mortgage calculator to see the impact of rising rates on your mortgage payments.

Our latest article on mortgage rates

You can click on the link below to read our latest article on mortgage rates