How do we level up housing as incomes fall?

This week, the Office of National Statistics (ONS) reported that household disposable incomes are falling and that income inequality is rising.

We look at what this means for the UK Housing market

What the ONS said

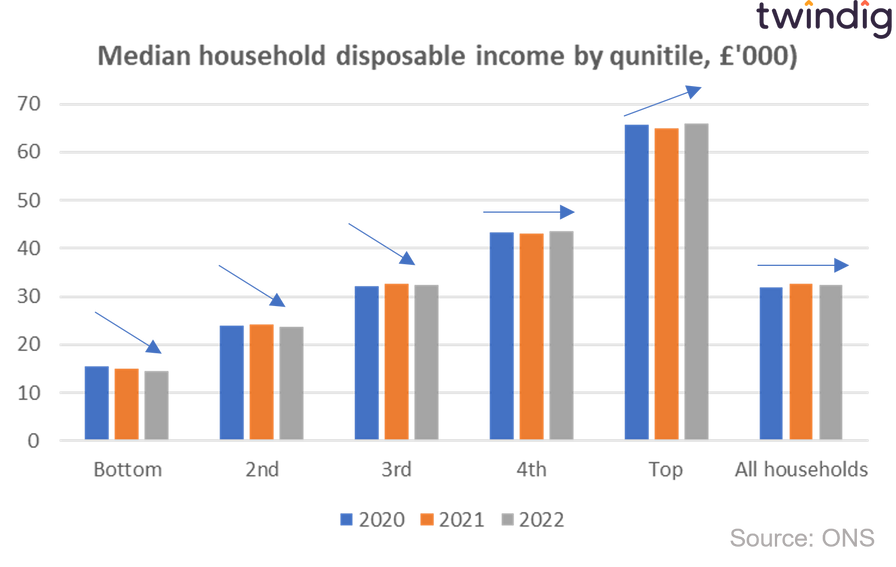

The median household disposable income in the UK was £32,300 in 2022, a decrease of 0.6% from 2021

The median disposable income for the poorest fifth of the population decreased by 3.8% to £14,500

The median disposable income of the richest fifth increased by 1.6% to £66,000.

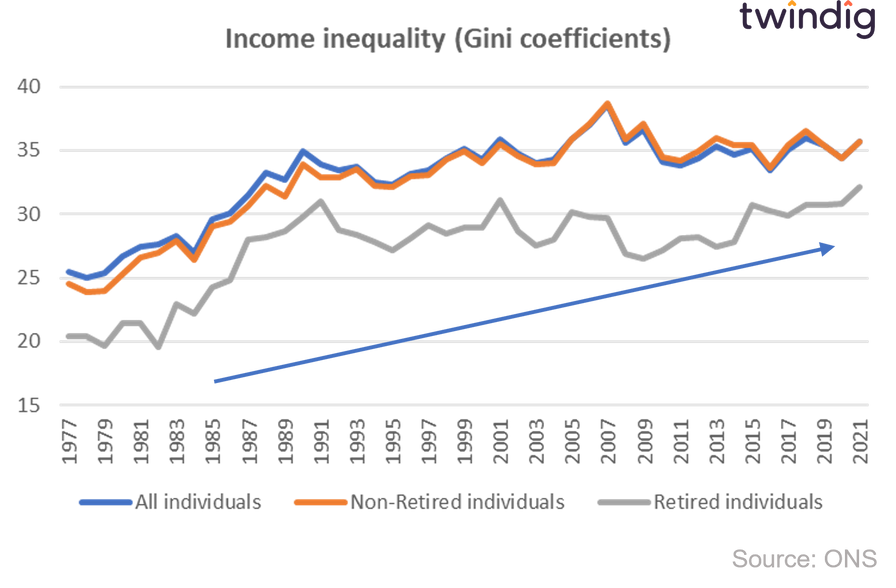

Income inequality for retired individuals reached a new high

Twindig take

Unfortunately, not only did median incomes fall, but income inequality rose. The median disposable income for the poorest fifth of the population decreased by 3.8% to £14,500, whereas the median disposable income of the richest fifth increased by 1.6% to £66,000. Growing income inequality has significant implications for the UK housing market.

Rising income inequality lowers the number of homebuyers

Income levels are key to determining how much you can borrow and, therefore, the size of your mortgage. The widening gap between the rich and poor will make it harder for many to get on the housing ladder, with those at the lower end of the income scale being shut out of homeownership.

Income inequality exacerbates the deposit problem: how to fill the gap between the price of the house you want to buy and the size of the mortgage you can secure.

Increasingly homebuyers are turning to the Bank of Mum and Dad to fill the deposit gap, but there is a problem. Income inequality is increasing among the retired population. Therefore, like incomes, access to the Bank of Mum and Dad is becoming more unequal.

How do we level up the housing market as incomes become more unequal?

Firstly there is no silver bullet. Life is not fair and not everyone will be able to buy their own home, but there is a way to allow more people to access housing wealth: fractional homeownership

Fractional homeownership

The barriers to homeownership are the requirement for a big income (and incomes are falling) to secure a mortgage and a big deposit to fill the gap between the mortgage and the house price.

We believe that rather than having to buy a whole home, which is increasingly difficult to do, we should be able to buy or invest in property on a pay-as-you-go basis. Invest or spend what you can afford rather than having to take on debt.

Fractional homeownership allows a would-be homebuyer or their parents and family to build up a deposit in a way that tracks house prices, rather than putting money in a low-interest savings account that is not linked to house prices at all.

Investing (or buying) monthly reduces the risk of buying at the top of the market or missing out on the bottom of the market, reducing the need to put all your eggs in one basket at one point in time.

We believe that a true residential property ISA would be a very popular product. The ISA market is worth about £70bn each year, of which c.£50bn is invested in low-interest cash ISAs. We suspect that many would jump at the chance if allowed to invest in property on a monthly pay-as-you-go basis. This would knock down the barriers to housing wealth, providing housing market access to those currently shut out.

If you would like to know more about fractional homeownership you can register here