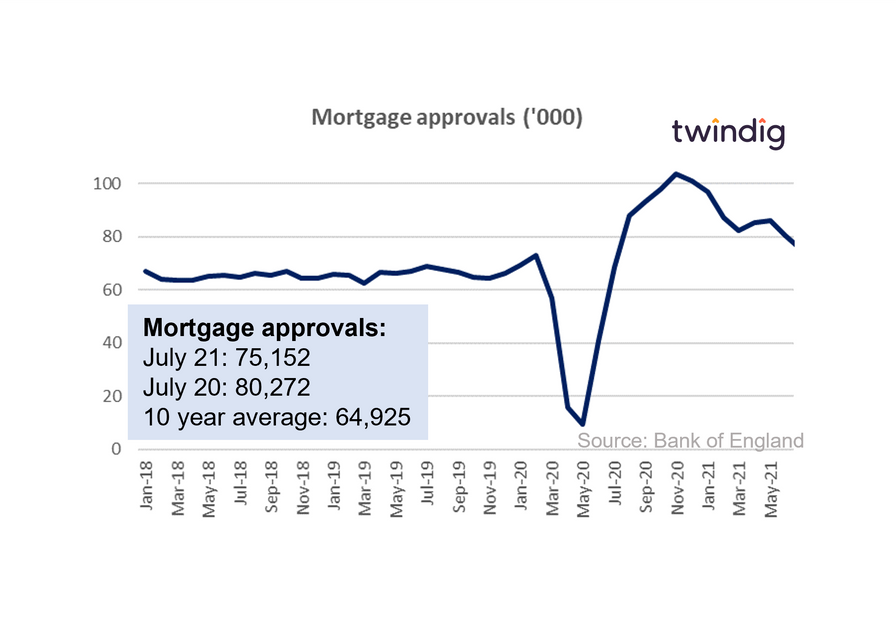

Mortgage approvals July 21 the giant cliff that looks like a small step

The Bank of England released mortgage approval data for July 2021 today

What they said

Seasonally adjusted Mortgage approvals for house purchase in July 75,152

6.4% lower than in June 2021

15.8% higher than the 10 year average

Twindig take

The giant stamp duty cliff edge looks like a small step for homebuyers. Mortgage approvals fell 6.4% in July following the first Stamp Duty holiday reduction, however, they remain 16% ahead of the 10-year average. It seems there was no 'cliff edge' to the first stamp duty holiday reduction, and if mortgage approvals were to continue to drift slowly back to their pre-pandemic levels most would view that as a good result.

The Stamp Duty holiday still has one month left to run and will end during the important autumn selling season. It will be interesting to see how this plays out, the rising demand from the autumn selling season (important for those who want to move before Christmas) coupled with the falling demand following the end of the stamp duty holiday (as many pulled forward their moving plans to take advantage of the stamp duty holiday), but so far the giant cliff for the housing market looks like one small step for homebuyers...