Mortgage approvals September

The Bank of England released its mortgage approval data for September this morning

What they said

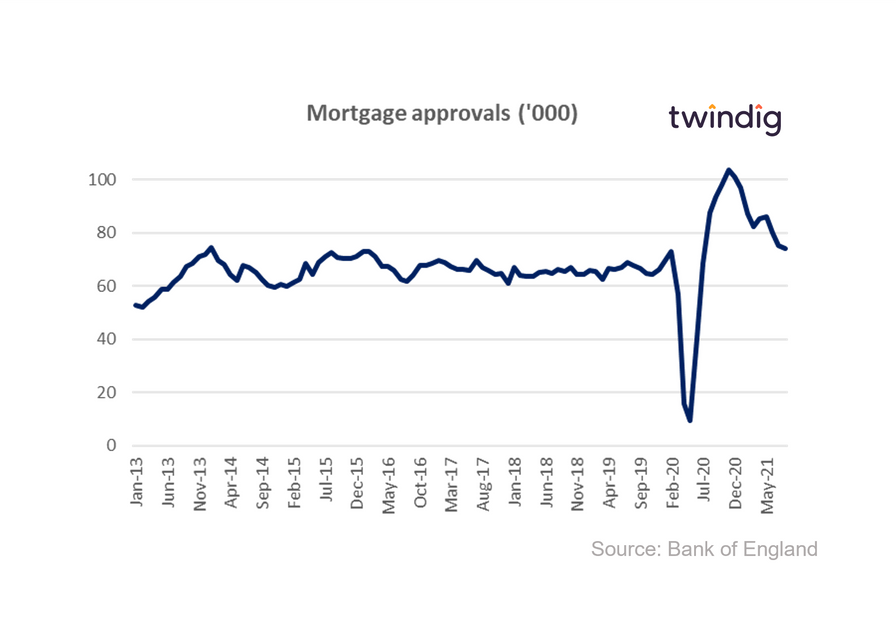

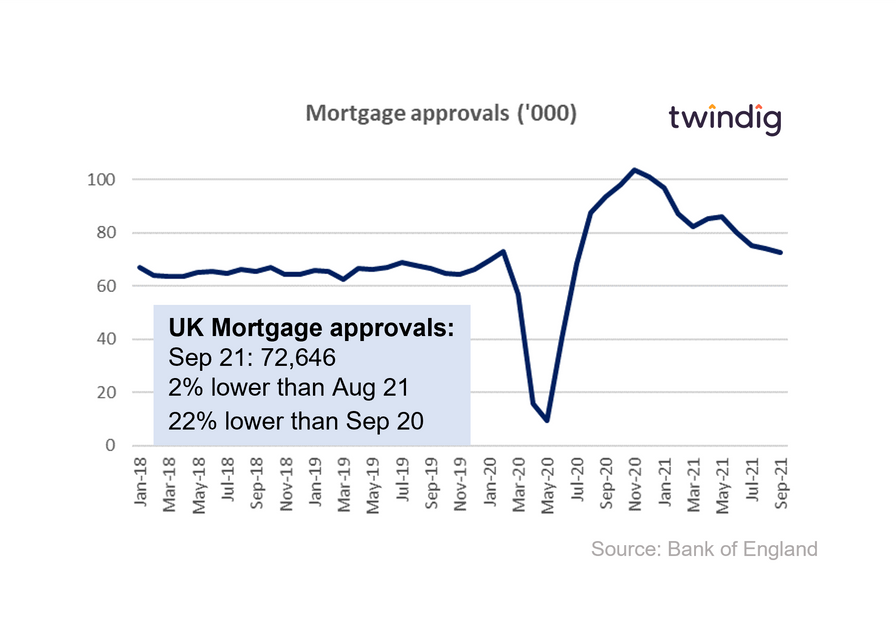

Mortgage approvals for September 2021 were 72,646

This was 2.1% lower than the 74,214 in August

This was 22% lower than the 93,409 in September 2020

Twindig take

The mortgage approvals chart tells the story of the pandemic and the stamp duty holiday, in our view. A dramatic fall as we entered lockdown 1 and during the period where UK housing market was effectively shut, followed by a surge in approvals during the stamp duty holiday.

It seems to us that mortgage approvals are returning to their normal levels, a case of mean reversion, as the stamp duty holiday drew to a close. Mortgages approved in September would have been very unlikely to have been used to finance house purchases also completing in September and therefore were approved against a backdrop of normal stamp duty thresholds.

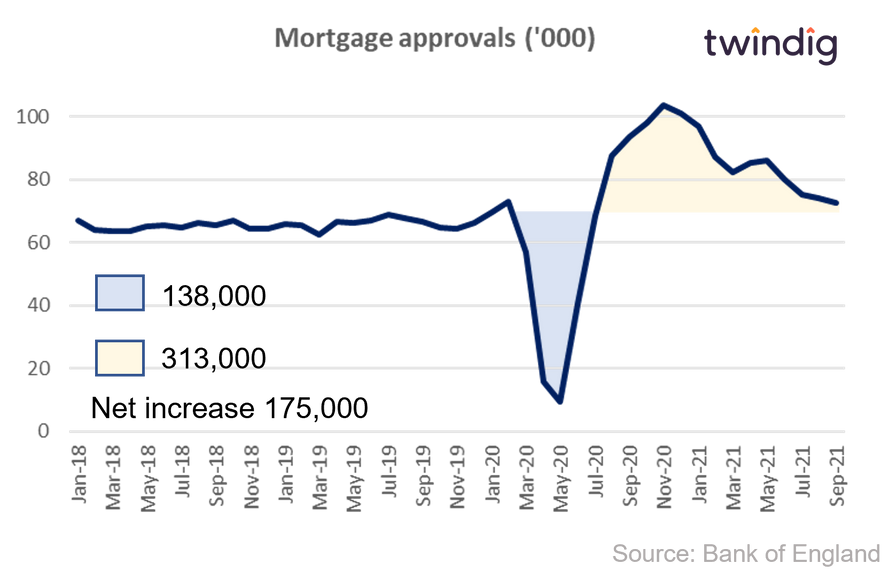

Whilst optically it looks as if the Covid dip is matched by the stamp duty rise if we look at how mortgage approvals since the start of the COVID-19 pandemic have varied from the 10 year monthly average we see that there was a 'fall' of 138,000 approvals followed by a 'gain' of 313,000 during the Stamp Duty Holiday as homebuyers pulled forward their home-buying plans or raced to but during the Stamp Duty Holiday.

Overall, since the start of the COVID-19 pandemic we have seen 175,000 mortgage approvals above the 10-year monthly average.

Mortgage approvals have been surprisingly stable mortgage approvals over the last few years, given the upheaval of Brexit, elections and COVID-19 and therefore we expect them to return to normal levels following the end of the Stamp Duty Holiday