Mortgage rates falling faster than house prices

Whilst some may view the announcement of falling house prices on the day of the next big game as a bad omen (come on England), perhaps the news that mortgage rates are falling faster than house prices redresses the balance and puts England ahead.

House prices fall by 0.5%

The Halifax reported today that house prices fell by 0.5% in June (although they are up 8.8% in the year) One could say they made it to the semis, but had a wobble...

But, mortgage rates falling faster

But that wobble was short-lived as later in the day the Bank of England reported that mortgage rates had fallen faster.

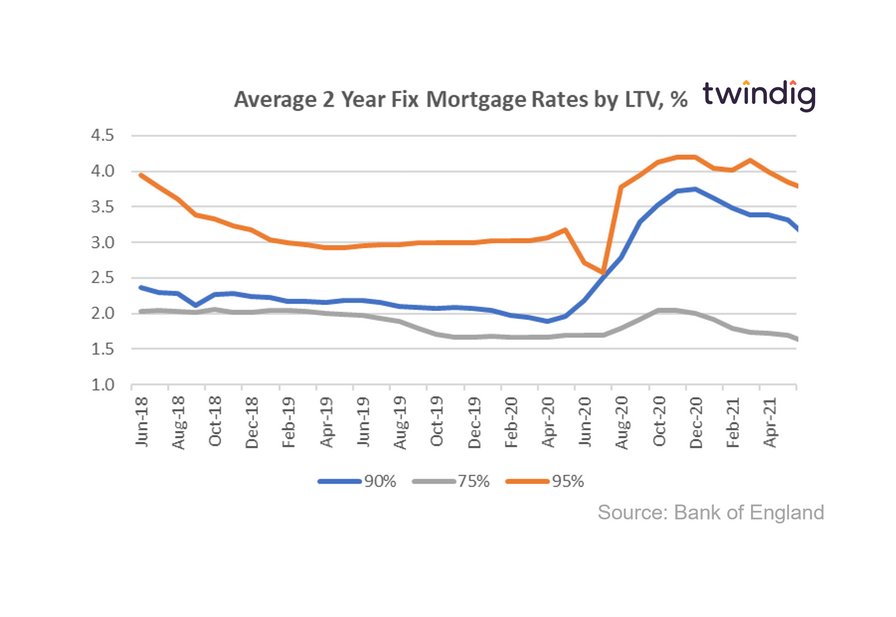

The average mortgage rates for popular mortgage products are as follows:

75% LTV mortgages 1.37% down 6.2% in the month

90% LTV mortgages 3.09% down 6.9% in the month

95% LTV mortgages 3.75% down 2.6% in the month

What does falling mortgage rates mean?

Falling mortgages rates normally means one of two things, either:

Banks are looking to sell more mortgages and are therefore lowering the price - simple economics to grow sales, or

Banks believe the risks of future house price falls and economic decline are lower than they were. Lower risk leads to lower prices

Both reasons are good news for homebuyers and those remortgaging because lower mortgage rates leads to lower mortgage payments.

Perhaps in this context, for homebuyers, lower house prices are the icing on the cake as this means a smaller mortgage and lower mortgage rates, but let's not forget that too much of a good thing can lead to indigestion.