Mortgage rates rise in August

The Bank of England released average mortgage rates by Loan to Value (LTV) today

What they said

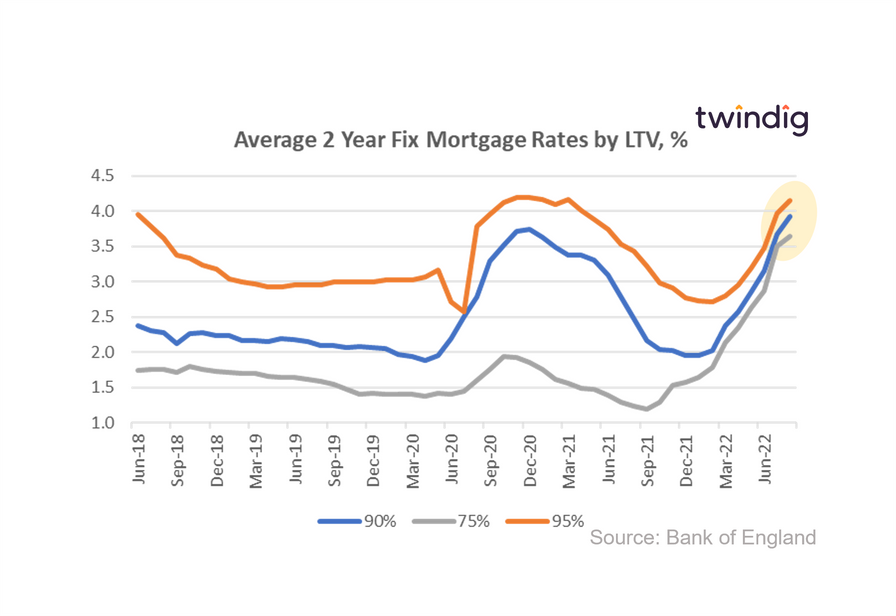

Average mortgage rate for 75% LTV 2-year fixed rates mortgages 3.64%

Average mortgage rate for 90% LTV 2-year fixed rates mortgages 3.92%

Average mortgage rate for 95% LTV 2-year fixed rates mortgages 4.15%

Twindig take

Mortgage rates rose again in August, but the rate of growth slowed. The average rate for 75% LTV mortgages increased by 4.0% in August to 3.64%, following a leap of 22% in July. The average rates for both 90% LTV and 95% LTV mortgages also increased at a slower rate in August.

The slowing growth will bring some comfort in a period of generally rising rates, however, the average mortgage rate for a 2-year fixed-rate 75% LTV mortgage has almost trebled (up 196%) over the last 12 months, leaping from 1.23% in August 2021 to 3.64% in August 2022.

With further increases in Bank Rate to come (the next MPC decision is expected on 15th September) we expect that mortgage rates will continue to rise in the coming months.

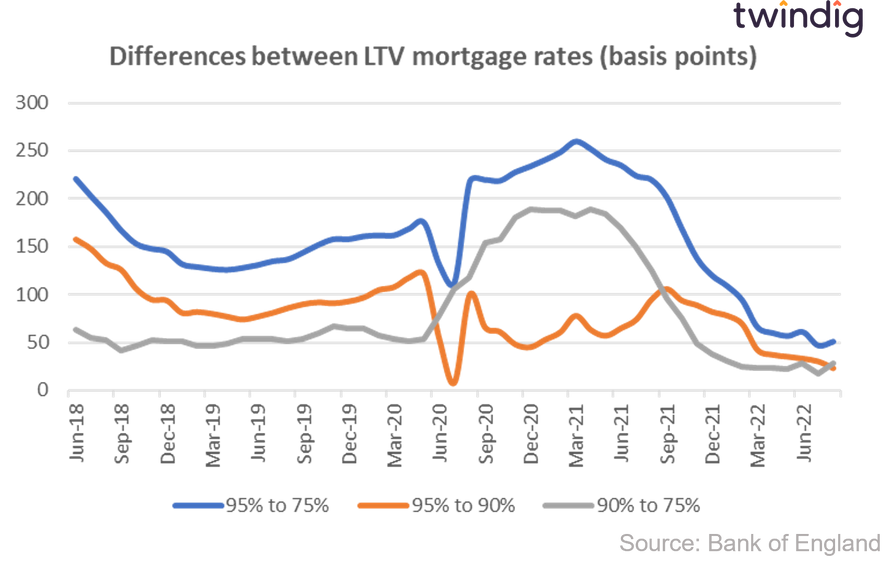

Changing spreads

The spread (or difference) between the relative mortgage rates is also much narrower than it has been and the graph below shows how the relationship between the rates has changed since the start of the COVID-19 pandemic.