Mortgage rates fall again

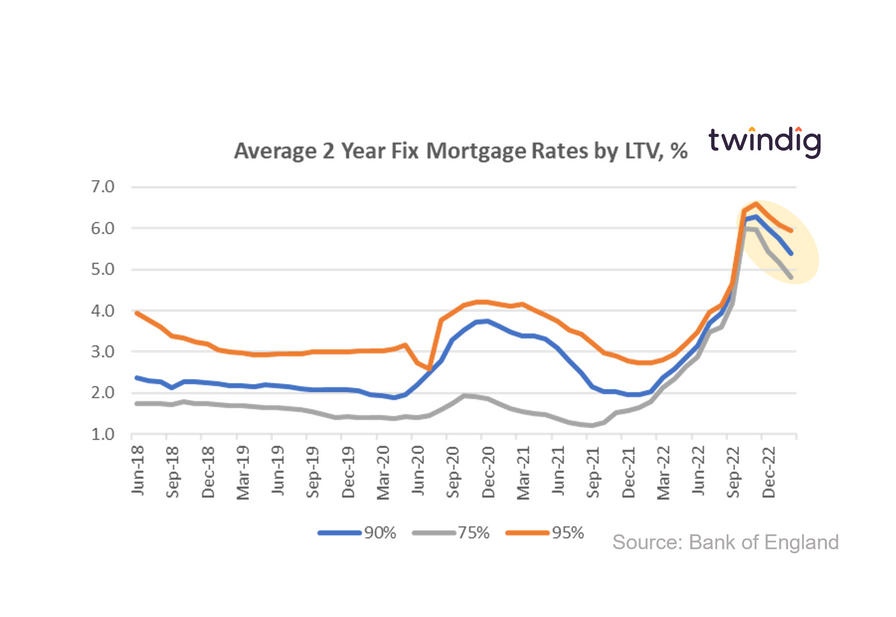

The Bank of England released average mortgage rates by Loan to Value (LTV) today

What the Bank of England said

Average mortgage rate for 75% LTV 2-year fixed rates mortgages 4.82% (down 35bp)

Average mortgage rate for 90% LTV 2-year fixed rates mortgages 5.38% (down 36bp)

Average mortgage rate for 95% LTV 2-year fixed rates mortgages 5.95% (down 15bp)

Twindig take

Mortgage rates continue to fall as financial stability continues to return to the financial markets. This is good news for homebuyers, because it means that not all costs of living are rising.

Average mortgage rates for 75% LTV 2-year fixed-rate mortgages have now fallen for four months in a row, and for three months in a row for 90% and 95% LTV 2-year fixed-rate mortgages.

Lower month on month

The average mortgage rate for 2-year fixed-rate mortgages for 75%, 90% and 95% mortgages fell by 6.8%, 6.3% and 2.5% respectively in February 2023

Higher year on year

However, mortgage rates remain significantly higher than they were one year ago. One year ago the average rate for a 75% LTV 2-year fixed rate mortgage was 1.78% today it is 4.82%, more than twice as high. Turning to 90% and 95% LTV two-year fixed rate mortgages, one year ago the average rates were 2.03% and 2.72% respectively.

How much will my mortgage cost?

You can see the impact of changing mortgage rates on your mortgage payments by using our mortgage calculator below