Mortgage rates rise again in May

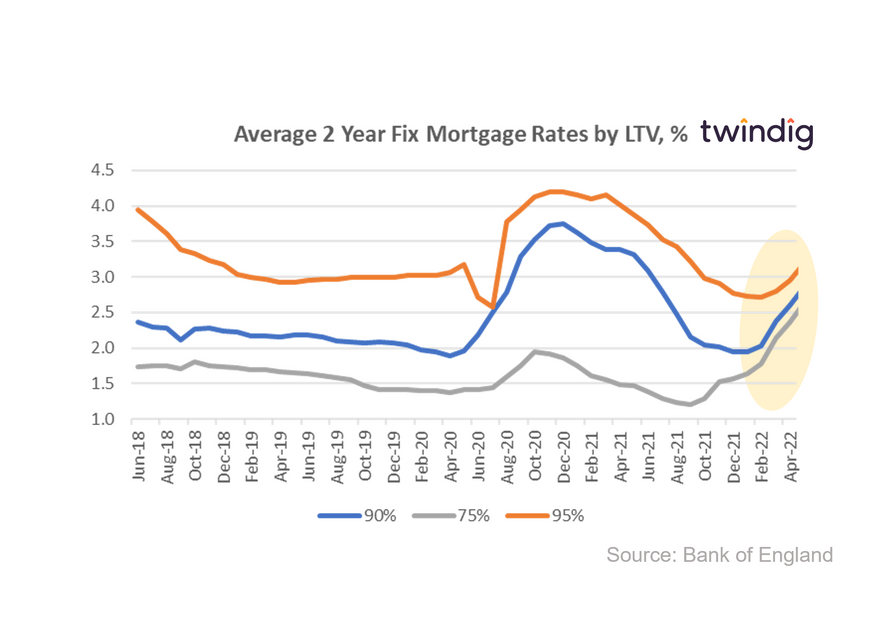

The Bank of England released average mortgage rates by Loan to Value (LTV) today

What they said

Average mortgage rate for 75% LTV 2-year fixed rates mortgages 2.63%

Average mortgage rate for 90% LTV 2-year fixed rates mortgages 2.86%

Average mortgage rate for 95% LTV 2-year fixed rates mortgages 3.19%

Twindig take

Mortgage rates continued to rise in May 2022. The average mortgage rate for a 2-year fixed-rate 75% LTV Mortgage increased by 11.4% in May to 2.63% and has increased by almost 80% since May 2021.

Interestingly although the average mortgage rates for 90% and 95% LTV 2-year fixed-rate mortgages increased by around 10% in May, both remain below the May 2021 levels.

Therefore although rates are rising it is still possible to secure a very attractive mortgage rate, but one might have to hurry...

How much will I pay on my mortgage?

You can use the twindig mortgage payment calculator to see how much your current and future mortgage payments will be as mortgage rates rise

Mortgage rates expected to rise again

We expect that these mortgage rates will continue to increase and the Bank of England Monetary Policy Committee will report its latest decision on Bank Rate on Thursday 16th June at 12 noon.

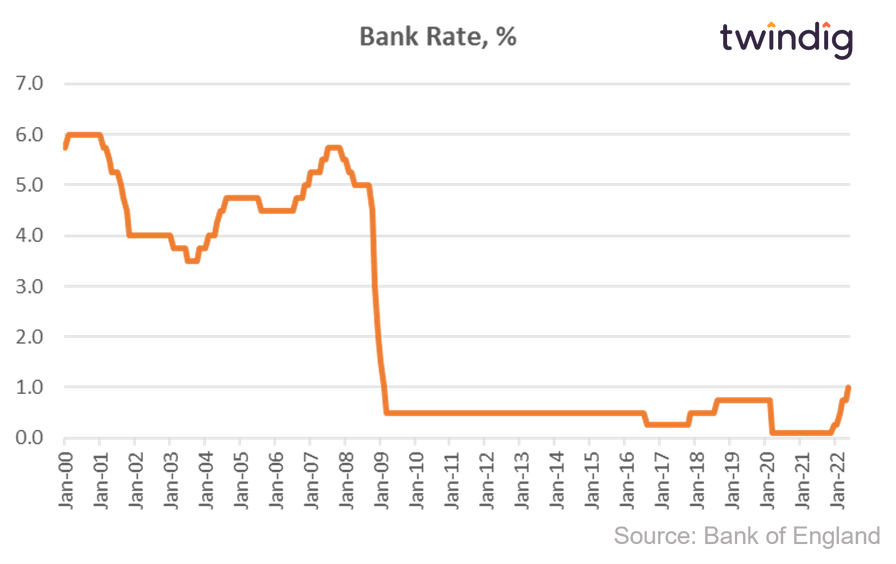

The current consensus is that Bank Rate will increase to 1.25% (up from 1.0%) on Thursday, this would be its highest level since January 2009.

A group of economists polled by news agency Reuters expected Bank Rate to reach 2.0% in September and to hit 3.0% in March 2023.

Should Bank rate reach 3.0% in 2023, whilst it does seem high, in context even of recent history 3.0% would still be considered low as illustrated in the graph below