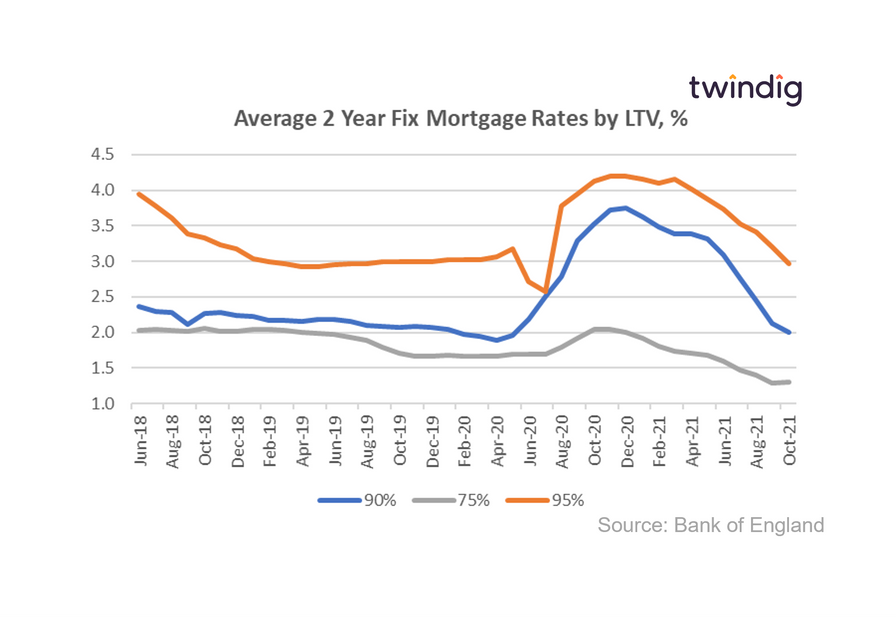

High LTV mortgage rates fall again

The Bank of England released data today about mortgage rates by Loan To Values (LTVs)

What they said

Average mortgage rate for 75% LTV mortgages 1.29%

Average mortgage rate for 90% LTV mortgages 2.00%

Average mortgage rate for 95% LTV mortgages 2.97%

Twindig take

Average mortgage rates for most new mortgages are still falling, but one of the latest mortgage rate movements is not what we expected. Overall mortgage rates across the Loan-to-Value (LTV) spectrum remain very low indeed, which should come as welcome relief, following all the speculation this week about rising mortgage rates for all those about to remortgage.

95% LTV Mortgages

The average mortgage rate on 95% LTV mortgages is 2.97% a fall of 7.5% from the previous month when the rate was 3.21%. On average the rate you can fix today is 28% lower than it was one year ago. This will be welcome news given the high levels of speculation this week that mortgage rates will be starting to rise.

90% LTV Mortgages

The average rate on 95% LTV mortgages is 2.00%, which is 6% lower than the previous month and 43% lower than the same time last year when the average rate was 3.52%. This again will be welcome news especially for those who are moving down the LTV scale as they re-mortgage from say a 95% LTV mortgage to a 90% LTV mortgage

75% LTV mortgages

The average mortgage rate on 75% LTV mortgages is currently 1.29% an increase of 7.5% compared to the average rate last month of 1.20%. We are surprised to see that the average mortgage rate for 75% LTV mortgages increased when those for the higher risk mortgages of 90% and 95% LTVs continued to decrease.

We appreciate that in the big scheme of things a mortgage rate of just 1.29% is very low indeed, but the increase goes against the trend. The explanation could be market-related, by which we mean that lenders have too much demand at these levels and are tweaking up mortgage rates to reduce the demand for these particular mortgage products.

Mortgage calculator

What does this mean for house prices?

Falling mortgage rates support further house price growth as a lower mortgage rate means the cost of a mortgage is cheaper and therefore you can afford to take on a bigger mortgage. Falling mortgage rates also imply that lenders are more optimistic about the future direction of house prices - because lower mortgage rates suggest that the risks attached to the mortgage are lower than they were and by offering lower mortgage rates lenders will expect to do more business.