House prices: no end in sight for dry January

The Nationwide released its house price index for January today

What the Nationwide said

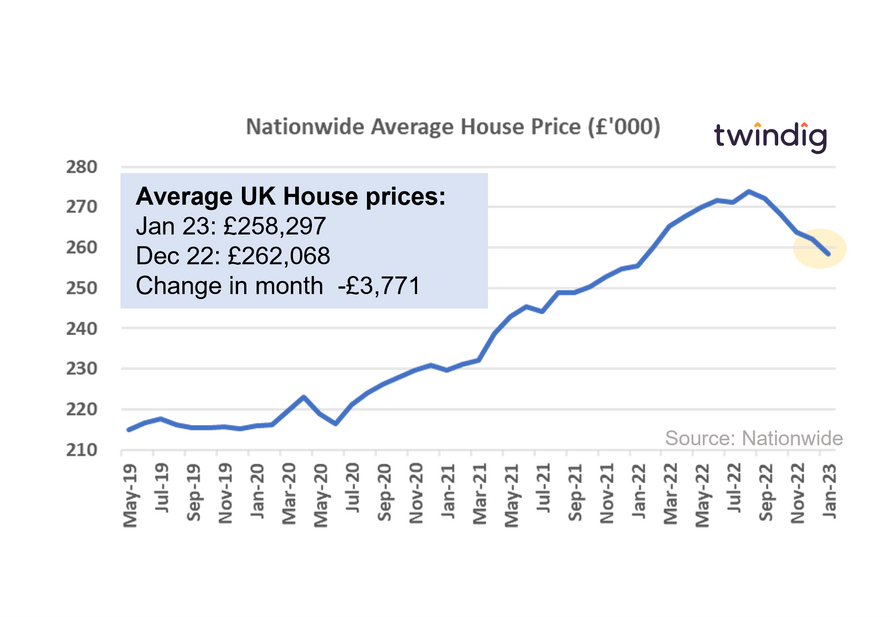

Average house price in January 2023 was £258,297

House prices fell by 1.4% or £3,771 in January

Annual house price inflation fell to 1.1% down from 2.8% in November 2022

Twindig take

Many, especially those partaking in dry January, will, like the housing market be happy to have left January behind them. House prices continued trending downwards in January, falling by £3,771 in the month to £258,297. But although many will be able to cheer themselves up with a drink this evening, the Nationwide, expects the January drought to continue:

“It will be hard for the market to regain much momentum in the near term as economic headwinds are set to remain strong, with real earnings likely to fall further and the labour market widely projected to weaken as the economy shrinks."

Whilst for homebuyers falling prices are a welcome tonic, rising living costs make it harder to save for a deposit and with inflation currently outstripping wage growth, there is little to cheer.

Mortgage rates are also continuing to rise, taking away some of the affordability gains of falling house prices.

Whilst the current situation appears somewhat bleak, there are some signs of light at the end of the tunnel. Mortgage rates and the rate of inflation are both likely to fall later in the year and as we saw during the COVID-19 pandemic the housing market often behaves in unexpected ways.

We continue to believe that house prices will fall by around 7-8% this year and that confidence and optimism will return in the second half of the year. Housing transactions are likely to be around 20% lower in 2023 than in 2022 in our view as mortgage supply and credit conditions temper the market in the first half of the year.