Thinking outside the homeownership box

Homebuyers and homeowners are increasingly worried about mortgage rates rising and house prices falling. Is the answer just to buy increasingly smaller and smaller homes or is now the time to think outside the box and change the way we finance our homes and manage house price risk?

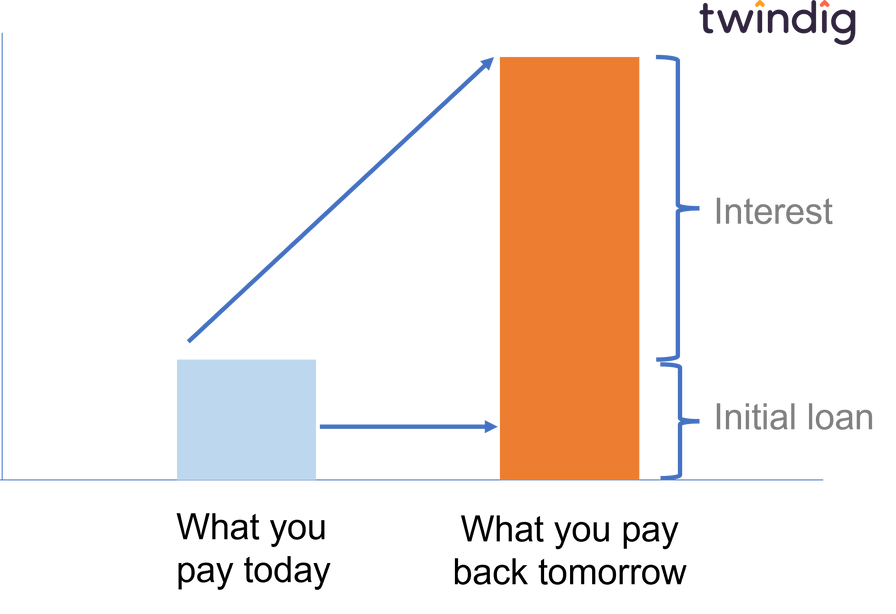

The problem of buying today, but paying tomorrow

We buy our homes at a fixed point in time, but increasingly are spreading the cost over decades, and as many are finding out, this opens the gates of uncertainty, and the mortgage payments you have to make over the years to come may be much larger than those you hoped for.

Worried about your future mortgage payments? Use our mortgage payment calculator

Can we learn from the pension market?

Aside from housing, our most significant investment tends to be our pensions. When we retire, our pension pot may well have a similar value to our home, but it will have been purchased month by month over our working lives rather than on a single day. If we trust this method to provide for us in our retirement and leisure years, should we not try to apply its model to the housing market?

Spread the risks

The risks in our pension pot will be widely spread, with a few eggs in many baskets, whereas our homes represent one big basket containing many eggs.

By contributing to our pensions monthly, we reduce the risk of buying at the top of the market and increase the chances that we are buying at or around the bottom of the market. We also purchase our pensions by investing the money we have rather than borrowing (and paying interest on) money we don't have.

Our primary residence is primarily a home rather than a financial investment. However, we cannot ignore the fact that they are also our biggest financial assets, therefore, we should buy them, like our pensions, with our heads rather than just our hearts to mitigate risk and help protect us from the financial storms.

House prices

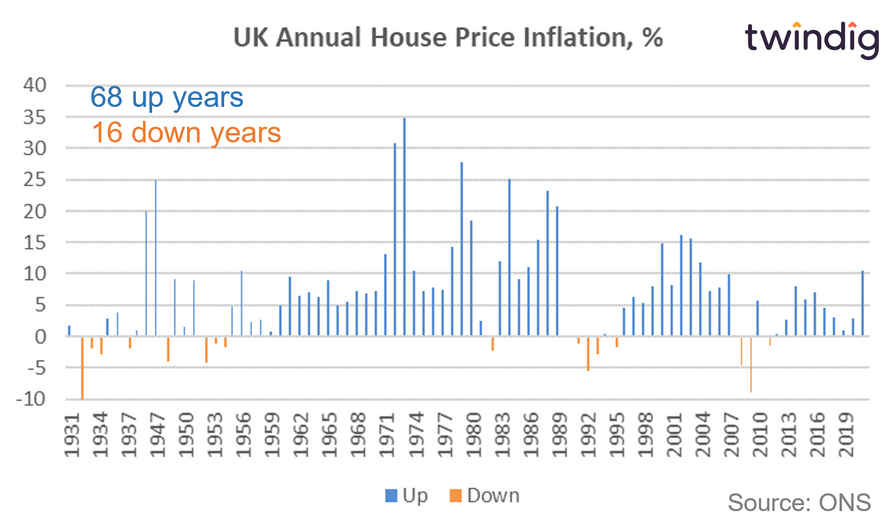

No one knows what will happen to house prices. No one accurately predicted what happened to house prices during the Global Financial Crisis. No one predicted the large house price gains of the last two and a half years.

Historically, the general direction is up, and I continue to believe that residential property will remain an attractive asset in the medium to long term, but accurately predicting short-term movements is a fool's errand.

The doomsayers are predicting big house price falls as mortgage rates rise, whereas the house price bulls point to a shortage of homes for sale continuing to underpin prices and a weak pound leading to growing demand from overseas buyers.

As far as I can see, the only short-term certainty on house prices is that we cannot agree how far they will travel in either direction.

Control that which you can control

We cannot control house prices but we can control our exposure to house prices. The market for houses is very similar to the stock market. At any point in time, some people want to buy shares in Company X and others want to sell them. The buyers think that the share price will rise, and the sellers that the share price is high enough and is likely to fall.

The difference between the stock market and the housing market is that in the housing market you buy and sell one house at a time costing hundreds and thousands of pounds, whereas in the stock market you buy for a few pounds several shares in a company that is worth millions or billions of pounds.

It is easier, quicker and cheaper to buy a few shares in a large company than it is to buy or sell one small house. You can read more about the case for fractional homeownership by clicking the button below:

Twindaq homeownership outside of the box

In the current economic climate, it appears to many that the housing market is broken. You need a big deposit to get into the housing market and an even bigger mortgage to buy your home and the buying and selling process is long-winded, stressful and full of potholes. When buying and selling you roll the dice and hope that the timing of your purchase is perfect and that the price you pay is correct.

Twindaq knows that very few people end up paying the right price at the right time and that there are significant risks with locking in a purchase price today that will be paid back over many years with many different mortgage rates.

Twindaq aims to bring the benefits of pension investing to the housing market, allowing you to

Spread your investment across multiple properties, and

Spread your investment over many years to reduce the risks of buying at the top and increase your chances of buying near the bottom

Bringing homeownership home to all

We also want the property market to be open to all not just the wealthy so that all can take a stake in the housing market with as little as £1.

To find out more about twindaq, you can register your interest here and join the growing number of people thinking outside of the homeownership box