Twindig Housing Market Index 17 Dec 22

It was a busy week for the housing market where Bank Rate rose to 3.5%, house prices nudged up 0.3%, the Bank of England published its Financial Stability Report and inflation fell from 11.1% to 10.7%, and the Twindig Housing Market Index nudged up by 0.3% to 67.5.

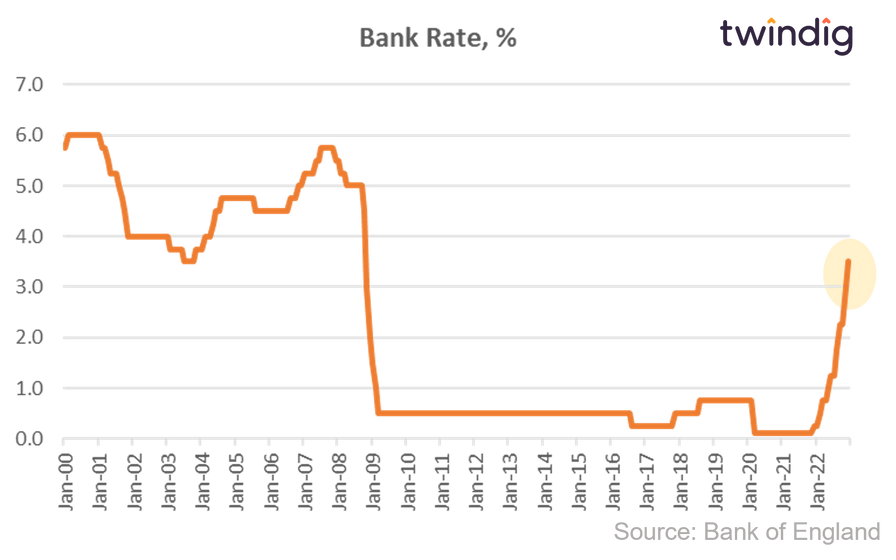

Bank Rate (up)

The increase in Bank Rate (from 3.0% to 3.5%) was widely expected, and therefore, residential investors took it in their stride. The market has also pencilled in further rises in Bank Rate next year as the Bank of England continues in its efforts to tame inflation.

Financial Stability Report (tough but stable)

The Financial Stability Report picked up on these and other themes, reading between the lines we suspect that the coming months will be challenging for the UK housing market, but as we enter the next recession we are in a stronger position than we were ahead of the recession of the early 1990s and the Global Financial Crisis. Although the tunnel is dark, there is light at the end of it.

House prices (up)

Given the views of the Bank of England, it might seem a little odd that the Land Registry reported that house prices rose in October. However, the Land Registry data, whilst more comprehensive, takes longer to collate than that of the Halifax and Nationwide house prices indices which are already reporting declines and, we expect the Land Registry data to follow suit in due course. Whilst we expect house prices to soften in the coming year, we are not expecting a house price crash. For more on why we thank that you can read our report Why house prices won't crash next year

Inflation (down)

When it came to the inflation numbers published this week, it was good news. Yes inflation remains painfully high, but it did reduce in November and reduced by more than most commentators and analysts had expected. We have a long way to go to get inflation down, but we are starting to make progress.