UK Housing Market Forecasts 2023

In this article, we set out our housing market forecasts for 2023. We forecast that UK house prices will fall by 8-10%; housing transactions to fall by more than 20% to around 960,000; Bank Rate to continue to increase to a peak of 5.25% in September 2023 before starting to fall. In 2022 the UK housing market played a game of two unequal halves, which were defined by the September mini-budget, rising before it and falling after it. We expect 2023 to be a challenging year, but with housing market conditions improving in the second half and possibly gaining momentum from September onwards.

House Price Forecast

Twindig expects UK house prices to fall by 8-10% in 2023

At the time of writing, it looked like UK house prices peaked in the late summer of 2022 and then started to fall. We expect 2023 to be characterised by house price falls of between 8-10%.

We estimate that most of these falls will occur in the first half of the year and expect house prices to be firmer from September onwards.

Rising mortgage rates and continued increases in the costs of living will drive the reduction in house price falls as rising mortgage rates reduce how much homebuyers can borrow and rising costs of living reduce their disposable income negatively impacting affordability.

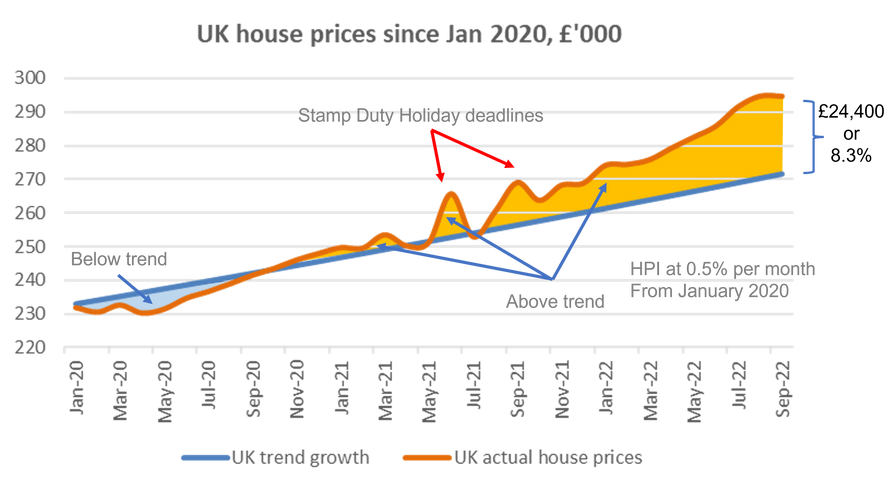

Our forecast is based on our view of where house prices are against long-term trends. Historically house prices have grown by around 0.5% per month, but during the COVID-19 pandemic house price growth was significantly above that trend, about 8% above. If house prices fell by 8% they would be back on their long-term trajectory (and still about 16% ahead of pre-COVID-19 lockdown levels).Our rule of thumb growth of 0.5% per month is based on long-term trends and a good indicator of the over or under-valuation of homes at a specific point in time. We are not saying that house prices will grow by 0.5% per month every month, but t has been a good rule of thumb if we look at long-term (25 years or more) trends.

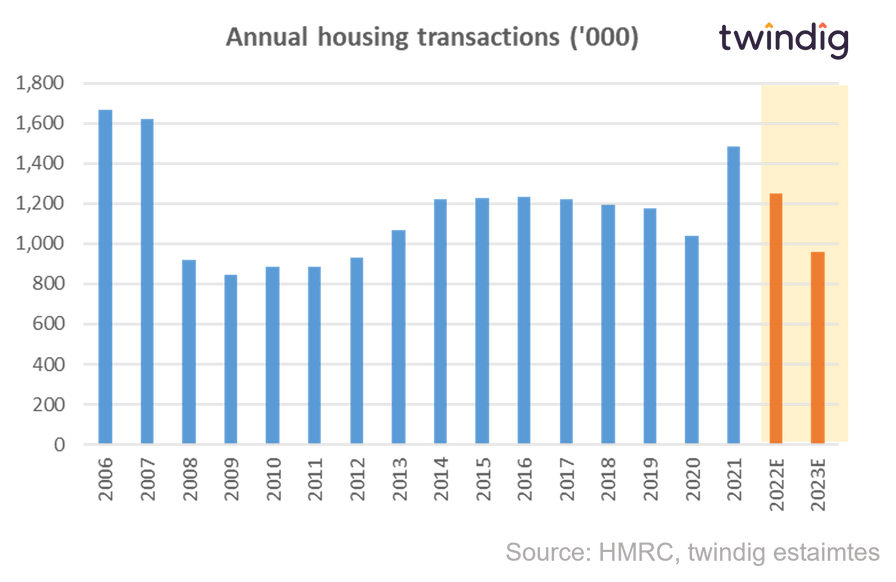

Housing transactions to fall by more than 20% in 2023

Our housing market transaction forecast is based on the assumption that there will be no additional Stamp Duty Holidays

The key lead indicator for housing transactions is, in our view, mortgage approvals and towards the end of 2022 they had started to fall, suggesting that future housing transactions will also be lower.

It is our view that as mortgage rates rise more and more homebuyers are priced out of the market and they do not have a large enough deposit to bridge the mortgage gap. As we enter 2023 we are also seeing a number of banks tighten their lending criteria which makes it harder to secure a mortgage and therefore fewer homebuyers will be able to get a mortgage. Banks are worried about the risks of falling house prices and rising mortgage defaults are mortgage rates and the costs of living rise.

The reduction in transactions will therefore be driven by reduced mortgage availability and homebuyers and home movers taking a wait-and-see approach in the first half of the year. The majority of home moves in 2023 will be needs-based rather than driven by aspirations and wants. We expect the volume of transactions to pick up in the autumn of 2023.

Mortgage rate forecast for 2023

The importance of Bank Rate

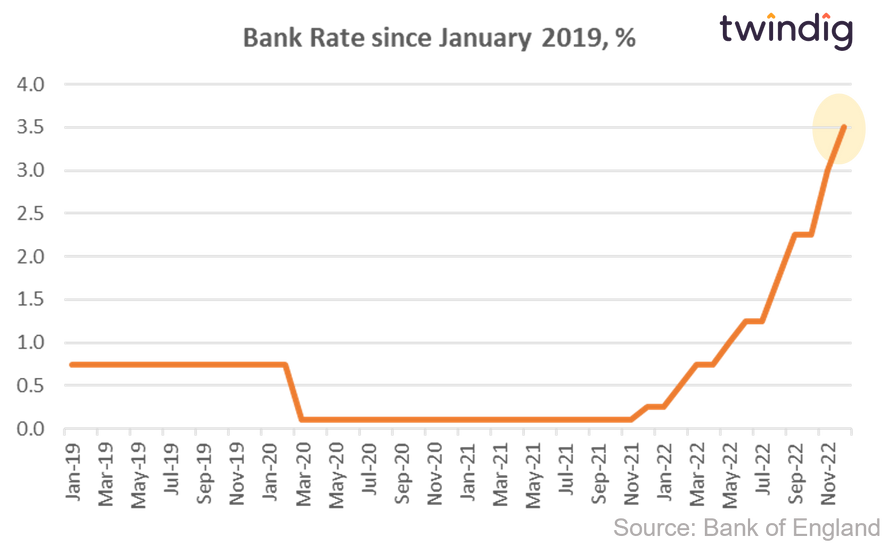

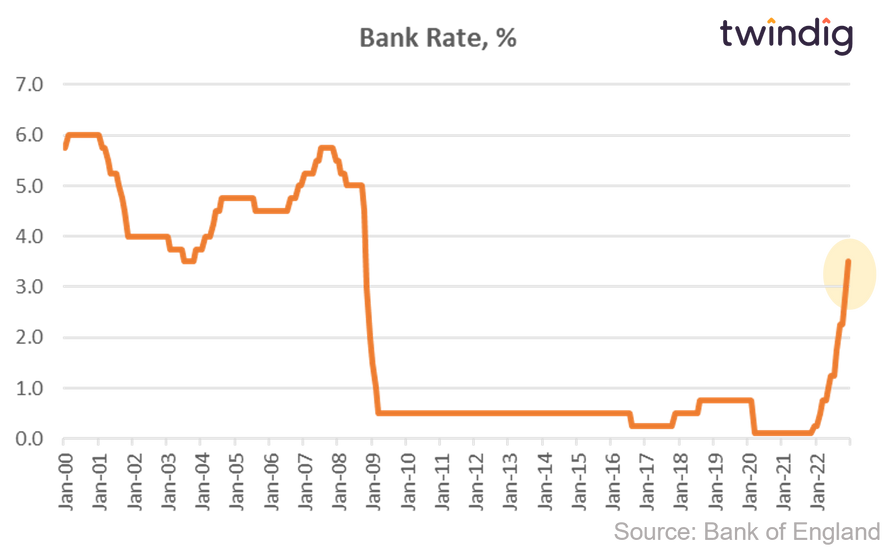

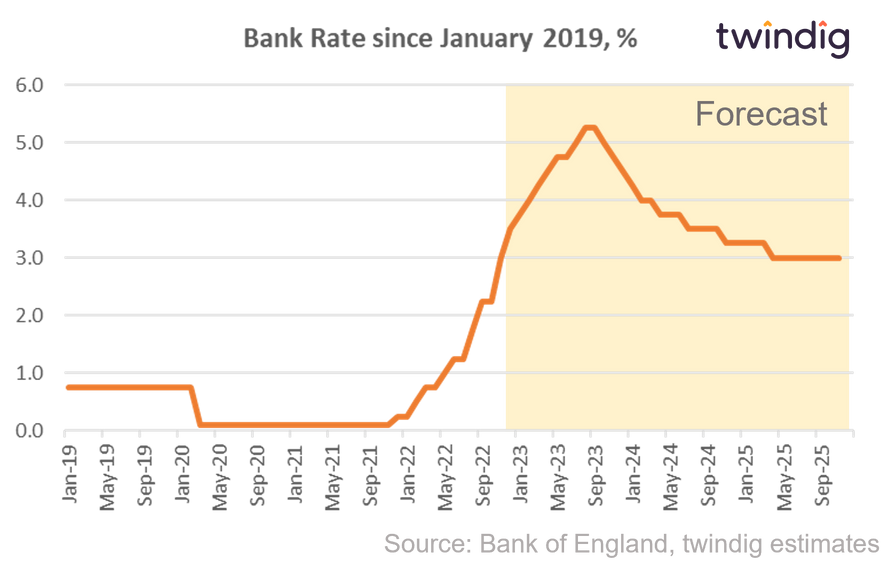

If one thing defined 2022 it was that of rising Bank Rate. After reaching an all-time low during the COVID-19 pandemic, which itself followed a decade-long period of ultra-low interest rates following the Global Financial Crisis, Bank Rate rose, and it rose quickly. From all-time lows of 0.1% in November 2021, Bank Rate has risen nine times reaching 3.5% in December 2022, its highest rate since October 2008.

Bank Rate is important because it is the underlying interest rate that impacts all other rates

In the context of history, 3.5% is still quite low and we expect Bank Rate to continue to rise in 2023

We expect Bank Rate to peak at 5.25% in September 2023 before starting to fall, although we expect the fall to be much slower than the rise. At December 2023 we forecast Bank Rate to be 4.5%.

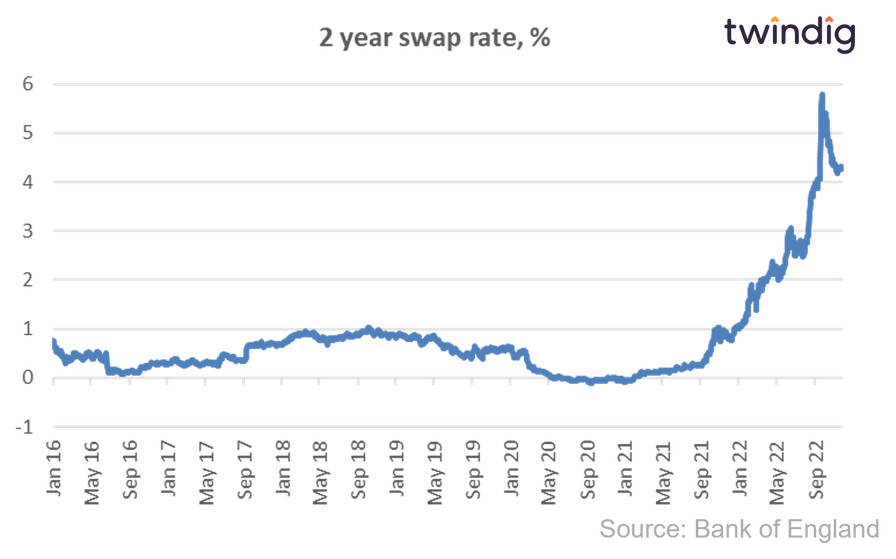

The importance of swap rates

Swap rates are very important when we are looking at mortgage rates. In simple terms, Swap Rates are what make fixed-rate mortgages possible. Interest rates are variable, they move up and down, normally following the market expectations for Bank Rate. If investors expect Bank Rate to rise, swap rates will also rise. Swap rates are the interest rate at which you can swap a variable interest rate for a fixed rate.

Swap rates can be viewed as the cost of a fixed-rate mortgage, they are the rate required for the seller to offer a buyer a fixed-rate mortgage i.e. if you pay me 5% pa, I'll guarantee your payments stay at 5% for two years - this is an example of a two-year swap rate.

The Bank of England has a tricky balancing act to perform, using interest rates to control inflation without causing households and the Government difficulties in servicing existing debts. It will also be aware that those with lots of debt (i.e. the Government) benefit from rising inflation. As inflation rises the real value of debt declines.

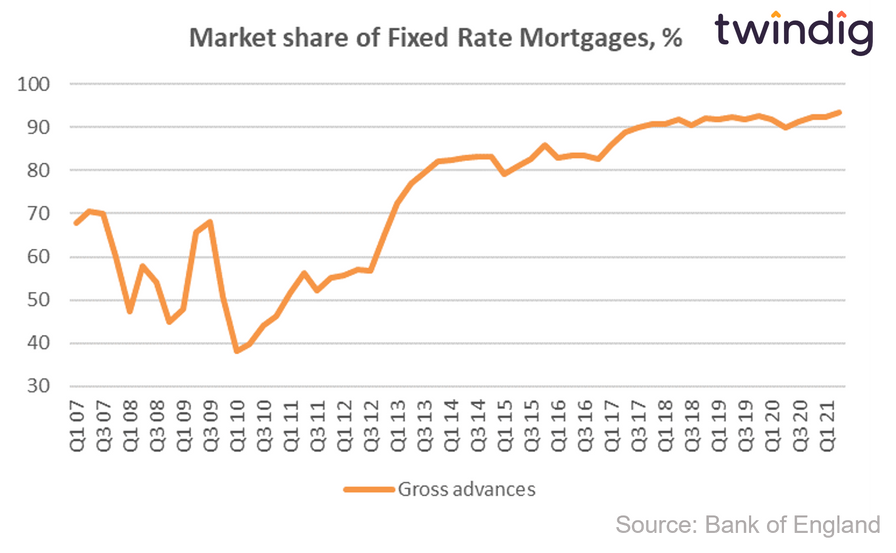

Those with mortgages might not be so sanguine about rising interest rates, but since 2013 the overwhelming majority of mortgage advances have been fixed-rate mortgages, therefore a rise in mortgage rate will not have any immediate impact.

Many homeowners will also have benefitted from significant house price inflation since they last arranged their mortgage, their Loan to Value (LTV), will, therefore, have fallen enabling them to secure a more favourable mortgage rate. You can read more about the impact of rising mortgage rates in our article Why rising mortgage rates might not hurt you

Bringing all the above analysis together, our mortgage rate forecasts for 31 December 2022 are as follows:

Bank Rate 4.5%

2 Year fixed-rate 95% LTV mortgage 7.50%

2 Year fixed-rate 75% LTV mortgage 5.50%

2 Year fixed-rate 60% LTV mortgage 5.00%

How much is my house worth?

Twindig has details for every home across the country, including yours. If you want to see an estimate of the current value of your home you can do so by visiting twindig or by clicking the button below

How accurate were our 2022 forecasts?

It would of course be easy to ignore what we said at the start of 2022, but we are happy for our forecasts to stand up to scrutiny.

House prices

We said house price inflation would be 5%

What actually happened? The latest data suggests house price inflation in 2022 was actually [ ].

We are pleased with our 2022 house price prediction

Housing Transactions

We predicted 1.00-1.10 million

What actually happened? The outturn is likely to be nearer 1.25 million housing transactions

Any mitigating factors?

We are happy to have been wrong on this one (more transactions is a good thing), the market following the stamp duty holiday was much stronger than we had anticipated and even the mini-budget didn't de-rail the market for long.

Interest rates

We predicted

Bank Rate 1.0%

2 Year fixed-rate 95% LTV mortgage 4.00%

2 Year fixed-rate 75% LTV mortgage 3.00%

2 Year fixed-rate 60% LTV mortgage 2.25%

What actually happened (latest data at the time of writing)

Bank Rate 3.5%

2 Year fixed-rate 95% LTV mortgage 6.57%

2 Year fixed-rate 75% LTV mortgage 6.25%

2 Year fixed-rate 60% LTV mortgage 5.97%

Any mitigating factors?

We got interest rates wrong. We didn't foresee the war in Ukraine starting nor the huge impact this would have on the cost of living and inflation. The Bank of England has been using Bank Rate and therefore interest rates as a way to control inflation.